Navigating the labyrinth of student loan repayment can feel overwhelming, but with the right strategies, we can accelerate the process and achieve financial freedom sooner. Student loans often represent a significant financial burden for millions of graduates, with the average borrower in the U.S. carrying over $30,000 in debt. Paying off this debt quickly not only reduces financial stress but also frees up resources for other life goals, such as homeownership, retirement savings, or starting a business. In this comprehensive guide, we provide actionable, detailed, and proven tips to repay student loans faster, tailored to various financial situations and lifestyles. From budgeting techniques to leveraging loan forgiveness programs, we cover every angle to help you take control of your debt.

- Understanding Your Student Loans: The Foundation for Faster Repayment

- Crafting a Budget to Accelerate Student Loan Repayment

- Prioritizing High-Interest Loans: The Avalanche Method

- Exploring the Snowball Method for Motivation

- Refinancing Student Loans for Lower Rates

- Leveraging Income-Driven Repayment Plans for Federal Loans

- Maximizing Loan Forgiveness Programs

- Making Extra Payments Without Penalties

- Increasing Income to Pay Off Loans Faster

- Reducing Living Expenses to Free Up Funds

- Using Windfalls and Bonuses Wisely

- Avoiding Common Repayment Mistakes

- Seeking Professional Financial Advice

- Maintaining Motivation Throughout Repayment

- Recommendations and Suggestions

- Frequently Asked Questions (FAQs)

Understanding Your Student Loans: The Foundation for Faster Repayment

Before diving into repayment strategies, we must understand the specifics of our student loans. Each loan type—federal or private—has unique terms, interest rates, and repayment options. Knowing these details empowers us to make informed decisions.

Types of Student Loans

-

Federal Student Loans: These include Direct Subsidized, Unsubsidized, and PLUS loans. Federal loans often offer flexible repayment plans, lower interest rates, and access to forgiveness programs.

-

Private Student Loans: Offered by banks, credit unions, or other lenders, private loans typically have higher interest rates and less flexible terms. Understanding the lender’s policies is crucial for strategic repayment.

-

Consolidation Loans: Combining multiple loans into one can simplify payments but may extend the repayment term or increase total interest paid.

Key Loan Details to Review

-

Interest Rates: Fixed or variable rates impact the total cost. Federal loans typically have fixed rates (e.g., 4.99% for Direct Loans in 2023), while private loans may vary widely.

-

Repayment Terms: Standard repayment plans span 10 years for federal loans, but extended or income-driven plans can stretch to 20–30 years.

-

Grace Periods: Federal loans often provide a six-month grace period post-graduation, while private loans may require immediate repayment.

-

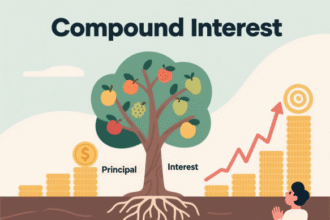

Total Balance: Knowing the principal and accrued interest helps prioritize high-interest loans.

We recommend accessing loan details through the lender’s online portal or the National Student Loan Data System (NSLDS) for federal loans. Reviewing these details monthly ensures we stay informed about interest accrual and repayment progress.

Crafting a Budget to Accelerate Student Loan Repayment

A well-structured budget is the cornerstone of repaying student loans faster. By allocating funds strategically, we can direct more money toward principal payments, reducing interest over time.

Steps to Create a Loan-Focused Budget

-

Track Income and Expenses: Use apps like Mint or YNAB to monitor cash flow. Categorize expenses into essentials (rent, utilities) and non-essentials (dining out, subscriptions).

-

Adopt the 50/30/20 Rule: Allocate 50% of income to needs, 30% to wants, and 20% to savings and debt repayment. Adjust to prioritize student loan payments.

-

Cut Non-Essential Spending: Reduce discretionary expenses, such as streaming services or frequent coffee runs, to free up $50–$200 monthly for loan payments.

-

Set a Debt Payoff Goal: Calculate how much extra you can pay monthly (e.g., $200 above the minimum) and use a loan calculator to estimate the payoff timeline.

Example Budget for a $30,000 Income

|

Category |

Amount |

Notes |

|---|---|---|

|

Rent |

$900 |

Essential |

|

Utilities |

$150 |

Essential |

|

Groceries |

$300 |

Essential |

|

Student Loan Payment |

$400 |

Minimum + $100 extra |

|

Transportation |

$200 |

Essential |

|

Entertainment |

$150 |

Reduced from $300 |

|

Savings |

$150 |

Emergency fund |

|

Miscellaneous |

$150 |

Flexible spending |

By cutting entertainment costs by $150, we can redirect that amount to student loans, shortening the repayment timeline significantly.

Prioritizing High-Interest Loans: The Avalanche Method

The debt avalanche method focuses on paying off high-interest loans first, minimizing total interest paid. This approach is ideal for borrowers with multiple student loans, especially private loans with variable rates.

How to Implement the Avalanche Method

-

List All Loans: Include balance, interest rate, and minimum payment for each loan.

-

Pay Minimums on All Loans: Ensure no penalties or defaults occur.

-

Allocate Extra Funds to the Highest-Interest Loan: For example, if Loan A has a 7% rate and Loan B has a 4% rate, direct extra payments to Loan A.

-

Roll Over Payments: Once the highest-interest loan is paid off, redirect its payment to the next highest-interest loan.

Example: Avalanche Method in Action

|

Loan |

Balance |

Interest Rate |

Minimum Payment |

|---|---|---|---|

|

Loan A |

$10,000 | 7% | $132 |

|

Loan B |

$15,000 | 4% | $148 |

|

Loan C |

$5,000 | 5% | $66 |

With $500 available monthly, we pay minimums ($346) and apply the remaining $154 to Loan A. Once Loan A is paid off, we redirect $286 ($132 + $154) to Loan C, then to Loan B, saving thousands in interest.

Exploring the Snowball Method for Motivation

The debt snowball method prioritizes loans with the smallest balances, providing psychological wins that motivate continued repayment. This is ideal for borrowers who thrive on quick progress.

Steps for the Snowball Method

-

List Loans by Balance: Order from smallest to largest, regardless of interest rate.

-

Pay Minimums on All Loans: Avoid late fees or penalties.

-

Direct Extra Payments to the Smallest Loan: Pay off the smallest balance first.

-

Roll Over Payments: Apply the full payment from the paid-off loan to the next smallest balance.

Example: Snowball Method

Using the same loans as above, we prioritize Loan C ($5,000), then Loan A ($10,000), then Loan B ($15,000). The quick win of paying off Loan C boosts momentum, even if it costs slightly more in interest compared to the avalanche method.

Refinancing Student Loans for Lower Rates

Refinancing involves replacing existing student loans with a new loan, ideally at a lower interest rate. This can significantly reduce monthly payments or total interest, allowing faster repayment.

Benefits of Refinancing

-

Lower Interest Rates: Dropping from 7% to 4% on a $30,000 loan can save thousands over the loan term.

-

Shorter Terms: Opting for a 5-year term instead of 10 years accelerates payoff.

-

Simplified Payments: Consolidating multiple loans into one streamlines budgeting.

Risks to Consider

-

Loss of Federal Benefits: Refinancing federal loans into private loans eliminates access to income-driven repayment and forgiveness programs.

-

Credit Requirements: Refinancing typically requires a credit score above 650 and stable income.

-

Variable Rates: Some refinanced loans have variable rates, which may increase over time.

Top Refinancing Lenders (2025)

-

SoFi: Offers competitive rates (starting at 3.99%) and flexible terms.

-

Earnest: Provides customized repayment plans and no fees.

-

LendKey: Connects borrowers with credit unions for lower rates.

We recommend comparing at least three lenders, checking rates without a hard credit pull, and ensuring the new loan aligns with our repayment goals.

Leveraging Income-Driven Repayment Plans for Federal Loans

For federal student loans, income-driven repayment (IDR) plans adjust payments based on income and family size, making them manageable for low earners. While IDR plans may extend the repayment term, strategic use can free up funds for extra payments.

Types of IDR Plans

-

Income-Based Repayment (IBR): Payments are 10–15% of discretionary income, with forgiveness after 20–25 years.

-

Pay As You Earn (PAYE): Caps payments at 10% of discretionary income, with forgiveness after 20 years.

-

Revised Pay As You Earn (REPAYE): Similar to PAYE but available to more borrowers, with interest subsidies.

-

Income-Contingent Repayment (ICR): Payments are the lesser of 20% of discretionary income or a standard plan amount.

Using IDR Strategically

-

Lower Monthly Payments: Reduced payments free up cash for extra principal payments on high-interest loans.

-

Forgiveness Potential: If pursuing Public Service Loan Forgiveness (PSLF), IDR plans qualify payments toward the 120 required for forgiveness.

-

Recertify Annually: Update income and family size yearly to keep payments affordable.

We suggest consulting the Federal Student Aid website to select the best IDR plan and using savings to target high-interest loans.

Maximizing Loan Forgiveness Programs

Loan forgiveness programs can significantly reduce student loan balances, particularly for public sector workers or those in specific professions.

Public Service Loan Forgiveness (PSLF)

-

Eligibility: Work full-time for a qualifying employer (government or nonprofit) and make 120 qualifying payments under an IDR plan.

-

Benefits: Remaining balance forgiven tax-free after 120 payments.

-

Tips: Submit Employment Certification Forms annually to track progress.

Other Forgiveness Programs

-

Teacher Loan Forgiveness: Up to $17,500 forgiven for teachers in low-income schools after five years.

-

Nurse Corps Loan Repayment Program: Up to 85% of loans repaid for nurses in underserved areas.

-

State-Based Programs: Many states offer forgiveness for professions like healthcare or education in high-need areas.

We recommend researching eligibility through the Federal Student Aid website and local state programs, as combining forgiveness with aggressive repayment can expedite debt freedom.

Making Extra Payments Without Penalties

Most student loans, especially federal ones, allow prepayments without penalties. Extra payments reduce the principal, lowering total interest and shortening the loan term.

How to Make Extra Payments

-

Specify Principal Payments: When paying online or by check, note that the payment is for the principal, not future installments.

-

Automate Payments: Set up biweekly or monthly overpayments to reduce interest accrual.

-

Use Windfalls: Apply tax refunds, bonuses, or gifts to loan balances.

Example: Impact of Extra Payments

For a $30,000 loan at 5% interest with a 10-year term, paying an extra $100 monthly reduces the payoff time to 8 years and saves over $2,000 in interest.

Increasing Income to Pay Off Loans Faster

Boosting income provides more funds for student loan repayment. We can explore multiple avenues to increase earnings, from side hustles to career advancements.

Side Hustle Ideas

-

Freelancing: Offer skills like writing, graphic design, or coding on platforms like Upwork or Fiverr.

-

Gig Economy: Drive for Uber, deliver for DoorDash, or tutor via Varsity Tutors.

-

Online Businesses: Start a blog, YouTube channel, or Etsy shop for passive income.

Career Advancement

-

Negotiate Raises: Research industry salaries and request a raise annually.

-

Upskill: Take online courses (e.g., Coursera, Udemy) to qualify for higher-paying roles.

-

Job Hopping: Switch employers for significant salary increases, especially in high-demand fields like tech or healthcare.

By adding $500 monthly from a side hustle, we can pay off a $30,000 loan in under 5 years instead of 10, assuming standard payments.

Reducing Living Expenses to Free Up Funds

Lowering expenses directly increases available funds for student loan repayment. We can adopt frugal habits without sacrificing quality of life.

Cost-Cutting Strategies

-

Housing: Move to a cheaper apartment, get a roommate, or relocate to a lower-cost area.

-

Transportation: Use public transit, bike, or carpool instead of owning a car.

-

Food: Cook at home, meal prep, and shop at discount stores like Aldi.

-

Subscriptions: Cancel unused services like gym memberships or streaming platforms.

Example: Savings Impact

Switching from a $1,200 apartment to a $900 shared apartment saves $300 monthly, which can be applied to loans, reducing a 10-year term to 7 years.

Using Windfalls and Bonuses Wisely

Unexpected income, such as tax refunds, inheritances, or work bonuses, can significantly accelerate student loan repayment.

How to Allocate Windfalls

-

Prioritize High-Interest Loans: Apply windfalls to loans with the highest rates.

-

Avoid Lifestyle Inflation: Resist spending bonuses on non-essentials like vacations.

-

Split Funds: Allocate 70% to loans, 20% to savings, and 10% for personal enjoyment.

A $2,000 tax refund applied to a $30,000 loan at 5% can reduce the payoff time by 6 months and save $500 in interest.

Avoiding Common Repayment Mistakes

To repay student loans faster, we must avoid pitfalls that extend debt or increase costs.

Mistakes to Avoid

-

Missing Payments: Late payments incur fees and damage credit scores.

-

Ignoring Interest Capitalization: Unpaid interest can add to the principal, increasing total debt.

-

Extending Loan Terms Unnecessarily: Longer terms reduce monthly payments but increase total interest.

-

Neglecting Forgiveness Options: Missing out on PSLF or other programs can cost thousands.

Regularly reviewing loan statements and consulting a financial advisor can help us stay on track.

Seeking Professional Financial Advice

A financial advisor or student loan counselor can provide personalized strategies for faster repayment.

Benefits of Professional Guidance

-

Customized Plans: Advisors tailor repayment strategies to our income, goals, and loan types.

-

Negotiation Support: Experts can negotiate with private lenders for better terms.

-

Tax Implications: Advisors clarify tax benefits, like interest deductions (up to $2,500 annually).

We recommend certified financial planners (CFPs) or nonprofit organizations like the National Foundation for Credit Counseling (NFCC) for affordable advice.

Maintaining Motivation Throughout Repayment

Repaying student loans is a long-term commitment, and staying motivated is key to success.

Motivation Tips

-

Celebrate Milestones: Reward yourself for paying off each $5,000 increment with a small treat.

-

Visualize Debt Freedom: Create a debt payoff chart or use apps like Debt Free to track progress.

-

Join Support Groups: Online communities like Reddit’s r/StudentLoans offer encouragement and tips.

By focusing on progress and celebrating small wins, we can maintain momentum toward debt freedom.

Recommendations and Suggestions

To repay student loans faster, we suggest combining multiple strategies tailored to our financial situation. Start by understanding loan terms, then create a budget to allocate extra funds toward principal payments. Use the avalanche or snowball method based on whether we prioritize savings or motivation. Explore refinancing for lower rates, but weigh the loss of federal benefits. Leverage IDR plans and forgiveness programs if eligible, and make extra payments with windfalls or side hustle income. Cut expenses strategically and seek professional advice when needed. Staying disciplined and motivated ensures we achieve debt freedom efficiently.

Frequently Asked Questions (FAQs)

-

What is the fastest way to repay student loans?

Combining the avalanche method, extra payments, and increased income through side hustles can significantly shorten the repayment timeline. -

Should I refinance my federal student loans?

Refinancing can lower rates but eliminates federal benefits like forgiveness. Evaluate your eligibility for programs like PSLF before refinancing. -

How does the debt avalanche method work?

Pay minimums on all loans and direct extra funds to the loan with the highest interest rate, then roll over payments to the next highest. -

Is the debt snowball method better than the avalanche method?

The snowball method prioritizes smaller balances for motivation, while the avalanche saves more interest. Choose based on your priorities. -

Can I make extra payments without penalties?

Most federal and private loans allow prepayments without penalties. Specify that extra payments go toward the principal. -

What are income-driven repayment plans?

IDR plans adjust federal loan payments based on income and family size, with forgiveness after 20–25 years. -

How do I qualify for Public Service Loan Forgiveness?

Work full-time for a qualifying employer, make 120 qualifying payments under an IDR plan, and submit annual certifications. -

Can side hustles help pay off loans faster?

Yes, additional income from freelancing, gig work, or online businesses can fund extra loan payments. -

What happens if I miss a loan payment?

Missed payments incur fees, damage credit, and may lead to default. Contact your lender immediately for solutions. -

Should I use my savings to pay off student loans?

Maintain an emergency fund (3–6 months’ expenses) before using savings for loans to avoid financial strain. -

How does interest capitalization affect my loans?

Unpaid interest adds to the principal, increasing total debt. Pay interest during grace periods to avoid this. -

Are there tax benefits for student loan payments?

You may deduct up to $2,500 in student loan interest annually, depending on income. Consult a tax professional. -

Can I negotiate with private lenders?

Some lenders may offer lower rates or better terms, especially with a strong credit score or financial advisor’s help. -

How do I track my loan repayment progress?

Use lender portals, apps like Debt Free, or spreadsheets to monitor balances and interest. -

What if I can’t afford my loan payments?

Apply for an IDR plan, deferment, or forbearance for federal loans, or contact private lenders for hardship options.