The burden of student loan debt weighs heavily on millions of Americans, with over $1.7 trillion in outstanding loans affecting more than 43 million borrowers. As we move into 2025, navigating the complex landscape of student loan forgiveness programs is crucial for those seeking financial relief. We understand the stress and uncertainty that come with managing educational debt, which is why we’ve crafted this comprehensive, in-depth guide to student loan forgiveness programs in 2025. Our goal is to provide you with actionable insights, detailed eligibility criteria, and step-by-step application processes to help you secure the debt relief you deserve. Whether you’re a public servant, a teacher, a healthcare professional, or a borrower facing financial hardship, this guide will illuminate the pathways to student loan forgiveness and empower you to take control of your financial future.

- Understanding Student Loan Forgiveness in 2025

- Major Federal Student Loan Forgiveness Programs in 2025

- Public Service Loan Forgiveness (PSLF)

- Eligibility Requirements for PSLF

- Application Process for PSLF

- Key Considerations for PSLF

- Real-Life Example

- Income-Driven Repayment (IDR) Forgiveness

- Types of IDR Plans in 2025

- Eligibility for IDR Forgiveness

- Application Process for IDR Forgiveness

- Key Considerations for IDR Forgiveness

- Real-Life Example

- Teacher Loan Forgiveness

- Eligibility Requirements for Teacher Loan Forgiveness

- Application Process for Teacher Loan Forgiveness

- Key Considerations for Teacher Loan Forgiveness

- Real-Life Example

- Borrower Defense to Repayment

- Eligibility Requirements for Borrower Defense

- Application Process for Borrower Defense

- Key Considerations for Borrower Defense

- Real-Life Example

- Total and Permanent Disability (TPD) Discharge

- Eligibility Requirements for TPD Discharge

- Application Process for TPD Discharge

- Key Considerations for TPD Discharge

- Real-Life Example

- Closed School Discharge

- Eligibility Requirements for Closed School Discharge

- Application Process for Closed School Discharge

- Key Considerations for Closed School Discharge

- Real-Life Example

- Perkins Loan Cancellation

- Eligibility Requirements for Perkins Loan Cancellation

- Application Process for Perkins Loan Cancellation

- Key Considerations for Perkins Loan Cancellation

- Real-Life Example

- National Health Service Corps (NHSC) Loan Repayment Program

- Eligibility Requirements for NHSC

- Application Process for NHSC

- Key Considerations for NHSC

- Real-Life Example

- Nurse Corps Loan Repayment Program

- Eligibility Requirements for Nurse Corps

- Application Process for Nurse Corps

- Key Considerations for Nurse Corps

- Real-Life Example

- Military Service Forgiveness Programs

- State and Local Student Loan Forgiveness Programs

- New Developments in 2025: The One Big Beautiful Bill

- How to Apply for Student Loan Forgiveness in 2025

- Common Mistakes to Avoid

- Suggestions and Recommendations

- Frequently Asked Questions (FAQs)

Understanding Student Loan Forgiveness in 2025

Student loan forgiveness refers to programs designed to reduce or eliminate federal student loan debt for eligible borrowers. These programs, primarily offered by the U.S. Department of Education, are tailored to incentivize careers in public service, education, healthcare, and other high-need fields or to provide relief for borrowers in specific circumstances, such as disability or school misconduct. In 2025, several updates to existing programs, along with new initiatives, have made forgiveness more accessible, though navigating the requirements remains a challenge. We aim to break down these complexities, ensuring you have the knowledge to pursue the right program for your situation.

The Importance of Federal Student Loans

Most student loan forgiveness programs apply exclusively to federal student loans, such as Direct Loans, Federal Family Education Loans (FFEL), and Perkins Loans. Private student loans, unfortunately, rarely qualify for federal forgiveness programs, though some state-specific or profession-based options may apply. If you hold FFEL or Perkins Loans, consolidating them into a Direct Consolidation Loan is often a prerequisite for eligibility. We recommend checking your loan type through the Federal Student Aid (FSA) portal at StudentAid.gov to confirm eligibility before applying.

Why 2025 Is a Pivotal Year

In 2025, the student loan forgiveness landscape has evolved significantly. The Biden administration has introduced reforms to streamline applications, clarify eligibility, and expand access to programs like Public Service Loan Forgiveness (PSLF) and Income-Driven Repayment (IDR) plans. Additionally, the introduction of the One Big Beautiful Bill, signed into law on July 4, 2025, has reshaped repayment structures, introducing the Repayment Assistance Plan (RAP) and refining existing IDR plans like the SAVE Plan. These changes aim to make forgiveness more attainable, but they also come with new deadlines and requirements that borrowers must navigate carefully.

Major Federal Student Loan Forgiveness Programs in 2025

Below, we outline the primary student loan forgiveness programs available in 2025, providing detailed eligibility criteria, application steps, and key considerations to maximize your chances of success.

Public Service Loan Forgiveness (PSLF)

The Public Service Loan Forgiveness (PSLF) program remains one of the most robust options for borrowers working in public service roles. Designed to reward those who dedicate their careers to government or nonprofit organizations, PSLF forgives the remaining balance of your federal Direct Loans after 120 qualifying monthly payments.

Eligibility Requirements for PSLF

To qualify for PSLF in 2025, you must meet the following criteria:

-

Employment: Work full-time (at least 30 hours per week) for a qualifying employer, such as a government agency (federal, state, local, or tribal) or a 501(c)(3) nonprofit organization. Some other nonprofits may qualify if they provide specific public services.

-

Loan Type: Only Direct Loans from the William D. Ford Federal Direct Loan Program qualify. FFEL or Perkins Loans must be consolidated into a Direct Consolidation Loan.

-

Repayment Plan: Payments must be made under an eligible Income-Driven Repayment (IDR) plan, such as SAVE, PAYE, IBR, or ICR. Standard repayment plans may qualify in some cases, but IDR plans are typically required.

-

Payment Count: Make 120 qualifying payments, which do not need to be consecutive. Each payment must be made on time, in full, and while employed full-time by a qualifying employer.

Application Process for PSLF

Applying for PSLF requires diligence and proactive record-keeping. Follow these steps:

-

Verify Employment: Use the PSLF Help Tool on StudentAid.gov to confirm your employer qualifies. Submit the Employment Certification Form annually or whenever you change jobs to track your qualifying payments.

-

Enroll in an IDR Plan: If not already enrolled, apply for an IDR plan through the FSA portal. The SAVE Plan is often the most affordable option, with payments as low as 5% of discretionary income.

-

Track Payments: Monitor your payment count through your FSA account. As of 2025, processing times have improved, with approvals typically taking 60-90 days, though incomplete documentation can cause delays.

-

Submit Final Application: After making 120 qualifying payments, submit the PSLF Application through StudentAid.gov. Include all required documentation, such as employer certifications and payment records.

Key Considerations for PSLF

-

Tax-Free Forgiveness: Unlike some other programs, PSLF forgiveness is not considered taxable income, providing significant financial relief.

-

Temporary Expanded PSLF (TEPSLF): If you don’t qualify for standard PSLF due to payments made under a non-qualifying repayment plan, you may be eligible for TEPSLF, which has limited funding and stricter criteria.

-

Common Pitfalls: Many borrowers face rejections due to missing employment certifications or incorrect repayment plans. We recommend setting calendar reminders to submit forms annually and keeping detailed records of all payments and employer documentation.

Real-Life Example

Consider Sarah, a public school teacher in California. She consolidated her FFEL Loans into a Direct Loan and enrolled in the SAVE Plan. By submitting her Employment Certification Form each year, she tracked her progress toward 120 payments. In 2025, after 10 years of service, Sarah had her remaining $50,000 balance forgiven tax-free, saving her thousands in future payments.

Income-Driven Repayment (IDR) Forgiveness

Income-Driven Repayment (IDR) plans adjust your monthly payments based on your income and family size, offering forgiveness of any remaining balance after 20 or 25 years, depending on the plan. In 2025, the SAVE Plan has emerged as the most borrower-friendly option, with significant updates to reduce payments and accelerate forgiveness timelines.

Types of IDR Plans in 2025

-

Saving on a Valuable Education (SAVE) Plan: Replaces the REPAYE Plan and offers payments as low as 5% of discretionary income for undergraduate loans. Forgiveness occurs after 20 years for undergraduate loans or 25 years for graduate loans. Borrowers with original loan balances of $12,000 or less may qualify for forgiveness after just 10 years.

-

Pay As You Earn (PAYE): Caps payments at 10% of discretionary income, with forgiveness after 20 years.

-

Income-Based Repayment (IBR): Payments are 10-15% of discretionary income, with forgiveness after 20 years for new borrowers (post-July 1, 2014) or 25 years for others.

-

Income-Contingent Repayment (ICR): Payments are the lesser of 20% of discretionary income or what you’d pay under a 12-year standard plan, with forgiveness after 25 years.

Eligibility for IDR Forgiveness

-

Loan Type: Most federal loans qualify, but FFEL and Perkins Loans require consolidation into a Direct Consolidation Loan. Parent PLUS Loans are eligible only for ICR after consolidation.

-

Income and Family Size: You must demonstrate financial need, typically defined as a high debt-to-income ratio. Payments can be as low as $0 for very low-income borrowers.

-

Annual Recertification: You must recertify your income and family size annually to remain in an IDR plan. Missing recertification deadlines can revert your plan to standard repayment, increasing payments.

Application Process for IDR Forgiveness

-

Apply for an IDR Plan: Use the IDR Plan Request Form on StudentAid.gov. Provide income documentation, such as tax returns or pay stubs.

-

Recertify Annually: Submit updated income and family size information each year. Set reminders three months in advance to avoid missing deadlines.

-

Track Payments: Monitor your payment history through your loan servicer to ensure all payments count toward forgiveness.

-

Apply for Forgiveness: After completing the required payment period (10-25 years, depending on the plan), submit a forgiveness application through your loan servicer.

Key Considerations for IDR Forgiveness

-

Tax Implications: Unlike PSLF, forgiven balances under IDR plans may be considered taxable income after 2025, depending on legislative changes. For example, if $50,000 is forgiven, you could owe taxes on that amount as if it were income.

-

SAVE Plan Benefits: The SAVE Plan reduces payments significantly and prevents unpaid interest from capitalizing, meaning your loan balance won’t grow even if your payments don’t cover the interest.

-

Legal Challenges: The SAVE Plan faced legal challenges in 2024, with payments paused temporarily. As of 2025, the plan is active, but borrowers should monitor updates at StudentAid.gov for any changes.

Real-Life Example

John, a social worker with $60,000 in federal loans, enrolled in the SAVE Plan in 2025. His payments were reduced to $150 per month based on his income. After 20 years of consistent payments, his remaining $30,000 balance was forgiven. However, he prepared for a potential tax bill by saving in a high-yield account throughout his repayment period.

Teacher Loan Forgiveness

The Teacher Loan Forgiveness program targets educators working in low-income schools, offering up to $17,500 in forgiveness for those who meet specific criteria.

Eligibility Requirements for Teacher Loan Forgiveness

-

Employment: Teach full-time for five consecutive academic years at a low-income elementary or secondary school or educational service agency, as listed in the Annual Directory of Designated Low-Income Schools.

-

Teacher Qualifications: Be a “highly qualified teacher” with a bachelor’s degree and full state certification. Requirements vary by state and grade level.

-

Loan Type: Direct Loans or FFEL Loans qualify. Loans must have been disbursed after October 1, 1998. Perkins Loans and PLUS Loans are ineligible.

-

Subject Area: Math, science, and special education teachers at secondary schools may qualify for up to $17,500. Other teachers may receive up to $5,000.

Application Process for Teacher Loan Forgiveness

-

Verify School Eligibility: Check the Low-Income School Directory to confirm your school qualifies.

-

Complete Five Years of Service: Ensure your teaching service is uninterrupted, as breaks reset the five-year clock.

-

Submit Application: After five years, complete the Teacher Loan Forgiveness Application and submit it to your loan servicer with documentation from your school confirming your employment and qualifications.

-

Processing Time: Approvals typically take 60-90 days, provided all documentation is complete.

Key Considerations for Teacher Loan Forgiveness

-

Exclusivity with PSLF: Time spent qualifying for Teacher Loan Forgiveness does not count toward PSLF. We recommend pursuing Teacher Loan Forgiveness first if eligible, then switching to PSLF for any remaining balance.

-

Tax Implications: Forgiveness is considered taxable income, so plan for potential tax liabilities.

-

Strategic Planning: If your loan balance is significantly higher than $17,500, PSLF may offer greater benefits due to its unlimited forgiveness amount.

Real-Life Example

Maria, a math teacher in a Title I school, taught for five consecutive years. She applied for Teacher Loan Forgiveness in 2025 and received $17,500 in forgiveness, reducing her $40,000 loan balance significantly. She then enrolled in PSLF to pursue forgiveness for the remaining balance.

Borrower Defense to Repayment

The Borrower Defense to Repayment program offers relief to borrowers who were misled or defrauded by their schools, particularly for-profit institutions.

Eligibility Requirements for Borrower Defense

-

School Misconduct: Provide evidence that your school engaged in deceptive practices, such as false job placement claims, misleading transfer credit promises, or failure to deliver promised educational services.

-

Loan Type: Applies to Direct Loans. FFEL and Perkins Loans require consolidation into a Direct Consolidation Loan.

-

School List: Over 150 schools, including ITT Technical Institute, DeVry University, and Corinthian Colleges, are listed in the Sweet v. Cardona settlement, making their former students eligible.

Application Process for Borrower Defense

-

Gather Evidence: Collect documentation, such as emails, promotional materials, or enrollment agreements, proving your school’s misconduct.

-

Submit Application: Complete the Borrower Defense to Repayment Application (approximately 25 pages) through StudentAid.gov. Each application is unique, requiring individualized evidence.

-

Await Processing: The Department of Education reviews applications within three years. If no response is received, loans may be automatically discharged.

-

Seek Assistance: Organizations like LoanSense offer application support to ensure accuracy and completeness.

Key Considerations for Borrower Defense

-

Urgency: With potential policy changes in 2025, applying promptly is critical, as future administrations may limit program availability.

-

No Templates: Generic applications are often rejected. Tailor your application with specific evidence of misconduct.

-

Tax-Free Forgiveness: Forgiven amounts are not taxable, providing significant financial relief.

Real-Life Example

David attended a for-profit college that closed in 2024 after investigations revealed fraudulent practices. He applied for Borrower Defense with evidence of misleading job placement promises and had his $40,000 loan balance discharged in 2025.

Total and Permanent Disability (TPD) Discharge

The Total and Permanent Disability (TPD) Discharge program forgives federal student loans for borrowers with severe, long-term disabilities.

Eligibility Requirements for TPD Discharge

-

Disability Status: Demonstrate a physical or mental impairment that prevents substantial gainful activity, expected to last at least 60 months or result in death.

-

Documentation: Provide certification from a physician, the Social Security Administration (SSA), or the Department of Veterans Affairs (VA). SSA documentation must show a disability review scheduled five to seven years after designation.

-

Loan Type: Direct Loans, FFEL Loans, and Perkins Loans qualify. Parent PLUS Loans may also be eligible.

Application Process for TPD Discharge

-

Obtain Documentation: Secure disability certification from a physician, SSA, or VA.

-

Submit Application: Complete the TPD Discharge Application on StudentAid.gov or through your loan servicer.

-

Monitoring Period: Approved borrowers may enter a three-year monitoring period to ensure they don’t exceed income thresholds or take out new loans.

-

Automatic Discharges: The Department of Education now uses data matching with SSA and VA to automatically discharge loans for eligible borrowers.

Key Considerations for TPD Discharge

-

Tax-Free Forgiveness: Discharged amounts are not taxable, providing full relief.

-

Streamlined Process: Automation has simplified the process, but manual applications are still required for some borrowers.

-

Reapplication: If your disability status changes, you may need to reapply or provide updated documentation.

Real-Life Example

Lisa, unable to work due to a permanent disability, submitted SSA documentation in 2025 and had her $25,000 loan balance discharged without tax consequences, easing her financial burden.

Closed School Discharge

The Closed School Discharge program forgives loans for borrowers whose schools closed while they were enrolled or shortly after withdrawal.

Eligibility Requirements for Closed School Discharge

-

School Closure: Your school must have closed while you were enrolled or within 180 days of your withdrawal.

-

Loan Type: Direct Loans, FFEL Loans, and Perkins Loans qualify.

-

Program Completion: You must not have completed your program through a teach-out at another school.

Application Process for Closed School Discharge

-

Verify Closure: Confirm your school’s closure date through the Department of Education’s records.

-

Contact Loan Servicer: Request the Closed School Discharge Application from your loan servicer.

-

Submit Documentation: Provide evidence of enrollment or withdrawal near the closure date.

-

Processing Time: Approvals typically take 90-120 days.

Key Considerations for Closed School Discharge

-

Tax-Free Forgiveness: Discharged amounts are not taxable.

-

For-Profit Colleges: Many closures involve for-profit institutions, making this program particularly relevant for affected borrowers.

-

Act Quickly: Delays in applying can complicate documentation requirements.

Real-Life Example

Alex’s for-profit college closed abruptly in 2024. He applied for Closed School Discharge in 2025 and had his $25,000 loan balance forgiven, allowing him to focus on his career without debt.

Perkins Loan Cancellation

The Perkins Loan Cancellation program offers gradual forgiveness for borrowers in specific public service roles, particularly teachers.

Eligibility Requirements for Perkins Loan Cancellation

-

Employment: Work in qualifying public service roles, such as teaching in low-income schools, special education, or other high-need fields like nursing, law enforcement, or librarianship.

-

Loan Type: Only Federal Perkins Loans qualify.

-

Service Period: Forgiveness is granted over five years:

-

15% after years one and two

-

20% after years three and four

-

30% after year five

-

Application Process for Perkins Loan Cancellation

-

Contact Loan Servicer: Reach out to the school that issued your Perkins Loan or its designated servicer.

-

Submit Documentation: Provide proof of qualifying employment for each year of service.

-

Track Progress: Monitor cancellation percentages annually to ensure accurate processing.

Key Considerations for Perkins Loan Cancellation

-

Tax-Free Forgiveness: Cancelled amounts are not taxable.

-

Limited Availability: Perkins Loans are no longer issued, but existing loans remain eligible.

-

Combine with Other Programs: You may pursue PSLF for Direct Loans while canceling Perkins Loans.

Real-Life Example

Mark, a special education teacher, had his $20,000 Perkins Loan fully canceled over five years by teaching in a low-income school, saving him significant interest and payments.

National Health Service Corps (NHSC) Loan Repayment Program

The NHSC Loan Repayment Program supports healthcare professionals serving in underserved areas, offering up to $50,000 in loan repayment for a two-year commitment.

Eligibility Requirements for NHSC

-

Profession: Qualify as a primary care clinician, including physicians, nurse practitioners, physician assistants, dentists, or mental health professionals.

-

Service Location: Work at an NHSC-approved site in a Health Professional Shortage Area (HPSA).

-

Loan Type: Federal and private student loans qualify, though federal loans are prioritized.

Application Process for NHSC

-

Check Site Eligibility: Verify your work location is an NHSC-approved site using the HPSA database.

-

Submit Application: Apply online through the NHSC website, providing proof of licensure and loan balances.

-

Service Commitment: Fulfill a two-year service obligation, with options to extend for additional repayment.

Key Considerations for NHSC

-

Competitive Program: Limited spots are available, so apply early in the annual cycle.

-

Combine with PSLF: Working at a nonprofit HPSA site may also qualify you for PSLF, maximizing forgiveness.

-

State Programs: Many states offer complementary programs, such as California’s State Loan Repayment Program, which provides up to $50,000.

Real-Life Example

Emily, a nurse practitioner, received $50,000 through the NHSC program for working in a rural clinic. She also enrolled in PSLF for her remaining federal loans, leveraging multiple programs for maximum relief.

Nurse Corps Loan Repayment Program

The Nurse Corps Loan Repayment Program supports registered nurses and nurse faculty in critical shortage areas, offering up to 85% forgiveness over three years.

Eligibility Requirements for Nurse Corps

-

Profession: Be a registered nurse, advanced practice registered nurse, or nurse faculty.

-

Service Location: Work at a Critical Shortage Facility, such as hospitals, nursing homes, or home health agencies.

-

Loan Type: Federal and private loans qualify.

Application Process for Nurse Corps

-

Verify Facility: Confirm your workplace is a Critical Shortage Facility.

-

Apply Online: Submit an application through the Health Resources and Services Administration (HRSA) website.

-

Service Commitment: Complete a two-year service obligation, with an optional third year for additional forgiveness.

Key Considerations for Nurse Corps

-

High Demand: Rural and underserved areas offer the most opportunities.

-

Taxable Forgiveness: Forgiven amounts may be taxable, so plan accordingly.

-

Combine with Other Programs: Pair with PSLF if working at a nonprofit facility.

Real-Life Example

Rachel, a registered nurse, received 85% forgiveness on her $80,000 loan balance by working in a critical shortage hospital, significantly reducing her debt burden.

Military Service Forgiveness Programs

Military personnel have access to unique student loan forgiveness programs, recognizing their service to the country.

Eligibility Requirements for Military Forgiveness

-

Service: Active duty, National Guard, or Reserve members may qualify for programs like the College Loan Repayment Program (CLRP).

-

Loan Type: Federal and private loans may qualify, depending on the program.

-

Service Commitment: Varies by branch, typically requiring 3-6 years of service.

Application Process for Military Forgiveness

-

Contact Branch Office: Reach out to your branch’s education office for program details.

-

Submit Documentation: Provide proof of loans and service commitment.

-

Combine Benefits: Use GI Bill benefits alongside forgiveness programs for maximum relief.

Key Considerations for Military Forgiveness

-

Branch-Specific Rules: The Army offers up to $65,000 through CLRP, while other branches have varying amounts.

-

PSLF Compatibility: Military service at qualifying employers counts toward PSLF.

-

Tax-Free Forgiveness: Most military forgiveness programs are tax-free.

Real-Life Example

James, an Army veteran, received $65,000 through CLRP and later pursued PSLF as a government employee, eliminating his entire $90,000 loan balance.

State and Local Student Loan Forgiveness Programs

In addition to federal programs, many states offer student loan forgiveness for professionals in high-demand fields. These programs often have shorter service commitments and can be combined with federal options.

California State Loan Repayment Program

-

Eligibility: Healthcare professionals, including physicians, nurses, and dentists, working in underserved areas.

-

Benefits: Up to $50,000 for a two-year commitment.

-

Application: Apply through the California Office of Statewide Health Planning and Development.

Texas Teacher Loan Forgiveness

-

Eligibility: Math and science teachers in high-need schools.

-

Benefits: Up to $5,000 annually.

-

Application: Submit through the Texas Education Agency.

Other State Programs

States like New York, Illinois, and Florida offer programs for teachers, healthcare workers, and lawyers. Check your state’s education or health department websites for details.

New Developments in 2025: The One Big Beautiful Bill

Signed into law on July 4, 2025, the One Big Beautiful Bill introduced the Repayment Assistance Plan (RAP), a new federal repayment structure starting in July 2026. Key features include:

-

Loan-Based Repayment Terms:

-

Loans under $25,000: 10-year repayment

-

$25,000-$50,000: 15-year repayment

-

$50,000-$100,000: 20-year repayment

-

Over $100,000: 25-year repayment

-

-

Payment Caps: Monthly payments range from $10 for incomes under $10,000 to 10% of adjusted gross income for higher earners.

-

No Balance Growth: Unpaid interest does not capitalize, reducing long-term debt.

-

Fixed Enrollment: Borrowers cannot switch out of RAP once enrolled.

Implications for Borrowers

While RAP offers lower payments for low-income borrowers, its extended repayment terms (up to 30 years for some) may increase total interest paid. We recommend comparing RAP with IDR plans to determine the best fit for your financial situation.

How to Apply for Student Loan Forgiveness in 2025

Navigating the application process for student loan forgiveness requires careful preparation. Follow these general steps for most programs:

-

Create an FSA Account: Log in to StudentAid.gov to manage your loans and applications.

-

Gather Documentation: Collect pay stubs, tax returns, employment certifications, and loan statements.

-

Select Your Program: Choose the forgiveness program that aligns with your career and loan type.

-

Submit Forms: Use the FSA portal to submit applications and required documents.

-

Track Progress: Monitor your application status and payment counts through your FSA account.

Tips for Success

-

Set Reminders: Mark deadlines for recertifications and employment certifications.

-

Keep Records: Maintain detailed records of payments, employment, and correspondence with loan servicers.

-

Avoid Scams: Legitimate programs never charge application fees. Verify all communications through StudentAid.gov.

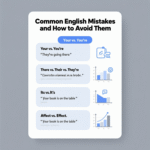

Common Mistakes to Avoid

-

Missing Deadlines: Late recertifications or employment certifications can disqualify payments.

-

Incorrect Repayment Plans: Ensure you’re enrolled in a qualifying IDR plan for PSLF or IDR forgiveness.

-

Incomplete Documentation: Double-check all forms for accuracy and completeness.

-

Ignoring Tax Implications: Plan for potential tax bills, especially for IDR and Teacher Loan Forgiveness.

Suggestions and Recommendations

To maximize your chances of securing student loan forgiveness in 2025, we recommend:

-

Start Early: Apply for programs as soon as you’re eligible to avoid missing deadlines.

-

Use Digital Tools: Leverage the PSLF Help Tool and Loan Forgiveness Timeline Calculator on StudentAid.gov.

-

Consult Experts: Work with a financial advisor or organizations like LoanSense for complex applications like Borrower Defense.

-

Stay Informed: Bookmark StudentAid.gov/news for updates on policy changes and new programs.

-

Combine Programs: Strategically pair programs like Teacher Loan Forgiveness and PSLF or state and federal options for maximum relief.

Frequently Asked Questions (FAQs)

-

What is student loan forgiveness?

-

Student loan forgiveness eliminates part or all of your federal student loan debt based on specific criteria, such as employment or financial hardship.

-

-

Who qualifies for PSLF in 2025?

-

Borrowers working full-time for government or nonprofit organizations with Direct Loans, making 120 qualifying payments under an IDR plan, qualify for PSLF.

-

-

Are private student loans eligible for forgiveness?

-

No, federal forgiveness programs apply only to federal loans. Some state or profession-specific programs may include private loans.

-

-

Is PSLF forgiveness taxable?

-

No, PSLF forgiveness is tax-free, providing significant financial relief.

-

-

How does the SAVE Plan work?

-

The SAVE Plan caps payments at 5% of discretionary income, with forgiveness after 20 years for undergraduate loans or 25 years for graduate loans.

-

-

What is Borrower Defense to Repayment?

-

This program forgives loans for borrowers misled or defrauded by their schools, requiring evidence of misconduct.

-

-

How long does Teacher Loan Forgiveness take?

-

Teachers must work five consecutive years in a low-income school to qualify for up to $17,500 in forgiveness.

-

-

What is the One Big Beautiful Bill?

-

Signed in 2025, it introduces the Repayment Assistance Plan (RAP), adjusting repayment terms based on loan amount.

-

-

Can I combine forgiveness programs?

-

Yes, but some, like Teacher Loan Forgiveness and PSLF, cannot be pursued simultaneously for the same period.

-

-

How do I apply for TPD Discharge?

-

Submit a TPD Discharge Application with disability documentation from a physician, SSA, or VA.

-

-

What happens if my school closes?

-

You may qualify for Closed School Discharge if your school closed during enrollment or within 180 days of withdrawal.

-

-

Are IDR forgiveness amounts taxable?

-

After 2025, forgiven amounts may be taxable unless legislative changes extend tax-free status.

-

-

How do I track PSLF payments?

-

Use the PSLF Help Tool and submit Employment Certification Forms annually to track progress.

-

-

What is the NHSC Loan Repayment Program?

-

It offers up to $50,000 for healthcare professionals serving two years in underserved areas.

-

-

How do I avoid student loan forgiveness scams?

-

Verify all programs through StudentAid.gov and avoid companies charging application fees.

-