Navigating the world of student loans can be daunting for international and domestic students alike, especially when pursuing higher education in countries like the USA, UK, and Canada. These nations are home to some of the world’s most prestigious universities, but the cost of education can be a significant barrier. Fortunately, a variety of student loan options are available to help bridge the financial gap, offering flexible terms, competitive interest rates, and tailored solutions for diverse needs. This guide provides an in-depth exploration of the best student loan options in the USA, UK, and Canada, covering eligibility, repayment terms, interest rates, and unique benefits to help students make informed financial decisions.

- Understanding Student Loans: A Foundation for Financial Planning

- Student Loan Options in the USA

- Federal Student Loans in the USA

- Private Student Loans in the USA

- Key Considerations for U.S. Student Loans

- Student Loan Options in the UK

- Government Student Loans in the UK

- Private Student Loans in the UK

- Key Considerations for UK Student Loans

- Student Loan Options in Canada

- Government Student Loans in Canada

- Private Student Loans in Canada

- Key Considerations for Canadian Student Loans

- Comparing Student Loan Options Across the USA, UK, and Canada

- Strategies to Minimize Student Loan Debt

- Recommendations and Suggestions

- Frequently Asked Questions (FAQs)

Understanding Student Loans: A Foundation for Financial Planning

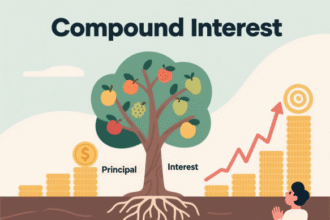

Student loans are financial tools designed to cover the costs of higher education, including tuition, living expenses, books, and other academic-related expenses. Unlike scholarships or grants, loans must be repaid, typically with interest, over a set period. The best student loan options vary by country, with each offering distinct programs tailored to domestic and international students. By understanding the nuances of these loans, students can select options that align with their financial goals and academic aspirations.

Types of Student Loans

- Federal Loans: Offered by governments, these loans typically have lower interest rates and more flexible repayment terms but are often restricted to citizens or eligible non-citizens.

- Private Loans: Provided by banks, credit unions, or online lenders, these loans are accessible to a broader range of students, including international students, but may require a co-signer or have higher interest rates.

- International Student Loans: Specifically designed for non-residents, these loans often focus on future earning potential rather than credit history, making them ideal for students without local financial ties.

- No-Cosigner Loans: A subset of private loans that do not require a co-signer, these are particularly appealing for international students who may lack a local guarantor.

Student Loan Options in the USA

The United States is a top destination for higher education, attracting over 1.1 million international students annually. However, the cost of attending U.S. institutions can exceed $70,000 per year at private colleges. Below, we explore the best student loan options in the USA for both domestic and international students.

Federal Student Loans in the USA

Federal student loans, administered by the U.S. Department of Education, are primarily available to U.S. citizens and eligible non-citizens. These loans are known for their favorable terms, including fixed interest rates and income-driven repayment plans.

- Direct Subsidized Loans: Available to undergraduate students with demonstrated financial need, these loans do not accrue interest while the borrower is in school or during deferment periods. Interest rates for 2025-2026 are approximately 6.39%.

- Direct Unsubsidized Loans: Open to both undergraduate and graduate students, these loans accrue interest from disbursement. Rates range from 6.39% for undergraduates to 8.94% for graduate students.

- PLUS Loans: Designed for graduate students or parents of dependent undergraduates, these loans cover up to the full cost of attendance but carry higher interest rates (around 8.94%) and require a credit check.

- Eligibility: Must be a U.S. citizen or eligible non-citizen, enrolled at least half-time in an eligible program, and maintain satisfactory academic progress.

- Repayment Terms: Options include Standard (10 years), Graduated (increasing payments over time), and Income-Driven Repayment (IDR) plans, which adjust payments based on income.

- Benefits: Forgiveness programs like Public Service Loan Forgiveness (PSLF) are available for borrowers working in qualifying public sector jobs after 120 on-time payments.

Private Student Loans in the USA

For international students or those ineligible for federal loans, private lenders offer viable alternatives. These loans often require a U.S.-based co-signer with good credit, though some lenders provide no-cosigner options.

Top Private Lenders in the USA

- SoFi

- Interest Rates: Fixed rates from 3.23% to 15.99% APR, variable rates from 4.39% to 15.99% with autopay discounts.

- Loan Amounts: $1,000 up to the full cost of attendance.

- Repayment Terms: 5 to 15 years, with options for deferred, interest-only, or full payments during school.

- Unique Features: No origination or late fees, $250 cash bonus for maintaining a 3.0 GPA, and access to financial planning services.

- Eligibility: Requires a co-signer for international students, with a minimum credit score of 640 for the co-signer.

- Why Choose SoFi: SoFi’s competitive rates, member perks, and flexible repayment options make it a top choice for both domestic and international students.

- Earnest

- Interest Rates: Fixed rates from 2.95% to 16.49% APR, variable rates from 4.99% to 16.85% with autopay.

- Loan Amounts: $1,000 up to the cost of attendance.

- Repayment Terms: 5 to 15 years, with a generous nine-month grace period post-graduation.

- Unique Features: No SSN required for international students (with customer support assistance), rate-match guarantee, and the ability to skip one payment per year without penalty.

- Eligibility: Minimum credit score of 650 for co-signers; international students must attend an eligible institution.

- Why Choose Earnest: Earnest’s accessibility for international students and longer grace period make it ideal for those needing extra time to secure employment post-graduation.

- Ascent Funding

- Interest Rates: Fixed rates from 2.98% to 14.41% APR, variable rates from 4.34% to 14.75% with autopay.

- Loan Amounts: $2,001 to $200,000 per academic year.

- Repayment Terms: 5 to 15 years for undergraduates, 5 to 20 years for graduates, with up to 24 months of forbearance for financial hardship.

- Unique Features: Offers no-cosigner loans for international students and DACA recipients, plus a 1% cash-back graduation reward.

- Eligibility: Co-signers need a minimum income of $24,000 and a variable credit score; no-cosigner loans assess future earning potential.

- Why Choose Ascent: Ascent’s no-cosigner options and flexible repayment terms cater to international students without U.S.-based financial support.

- MPOWER Financing

- Interest Rates: Fixed rates starting at 10.99% APR with discounts.

- Loan Amounts: $2,001 to $100,000.

- Repayment Terms: 10 years, with interest-only payments starting 45 days after disbursement and full repayment six months post-graduation.

- Unique Features: No co-signer or collateral required, visa support services, and career resources like resume builders and job search tools.

- Eligibility: Students must attend one of 500+ supported schools and be in their final two years of undergraduate or graduate studies.

- Why Choose MPOWER: MPOWER’s focus on future earning potential makes it a lifeline for international students without local co-signers.

- College Ave

- Interest Rates: Fixed rates from 2.95% to 17.99% APR, variable rates from 4.24% to 17.99% with autopay.

- Loan Amounts: $1,000 up to the cost of attendance.

- Repayment Terms: 5 to 15 years, with multiple repayment options including full deferment.

- Unique Features: Quick application process with instant credit decisions and a 0.25% autopay discount.

- Eligibility: International students need a U.S.-based co-signer with a credit score in the mid-600s.

- Why Choose College Ave: Its competitive rates and streamlined application process appeal to students seeking efficiency and affordability.

Key Considerations for U.S. Student Loans

- Co-Signer Requirements: Most private loans require a U.S. citizen or permanent resident co-signer with a strong credit history. Lenders like MPOWER and Prodigy Finance offer no-cosigner options, evaluating academic potential and future earnings instead.

- Cost of Attendance: Loans typically cover tuition, room and board, books, and living expenses, but students should calculate total costs to avoid over-borrowing.

- Repayment Flexibility: Look for lenders offering grace periods, forbearance, or income-driven repayment to ease financial burdens post-graduation.

- Scholarships and Grants: Explore university-specific or external funding (e.g., Fulbright Scholarships) to reduce reliance on loans.

Student Loan Options in the UK

The United Kingdom is renowned for its world-class universities, such as Oxford and Cambridge, but tuition fees can reach £38,000 annually for international students. The UK’s student loan system is primarily government-funded for domestic students, with limited options for international students. Below, we detail the best student loan options in the UK.

Government Student Loans in the UK

The UK government provides loans through the Student Loans Company (SLC) for UK and eligible EU students. These loans are income-contingent, meaning repayments are based on earnings after graduation.

- Tuition Fee Loans: Cover full tuition fees (up to £9,250 for UK students at public universities). International students are ineligible.

- Maintenance Loans: Help cover living costs, with amounts varying by household income and study location (up to £12,667 for students living away from home in London).

- Interest Rates: Linked to the Retail Price Index (RPI) plus up to 3%, capped at 7.3% for 2025.

- Repayment Terms: Repayments begin the April after graduation, only if earning above £25,000 (Plan 2 loans). Unpaid balances are forgiven after 30 years.

- Eligibility: Restricted to UK nationals, EU students with settled or pre-settled status, or those with indefinite leave to remain.

- Benefits: No credit checks, income-contingent repayments, and potential loan forgiveness make these loans attractive for eligible students.

Private Student Loans in the UK

International students in the UK often rely on private loans or home-country lenders due to limited access to government loans. Below are notable options:

- Prodigy Finance

- Interest Rates: Variable rates starting at 8.35% APR (average 13.37% APR).

- Loan Amounts: Up to 100% of tuition and living expenses.

- Repayment Terms: 7 to 20 years, with a six-month grace period post-graduation.

- Unique Features: No co-signer or collateral required, focuses on future earning potential, and supports students at over 1,800 global schools.

- Eligibility: Master’s students in Business, STEM, Law, Health Sciences, or Public Policy at eligible UK institutions.

- Why Choose Prodigy: Its no-cosigner model and global reach make it ideal for international students without UK-based financial ties.

- Future Finance

- Interest Rates: Variable, typically 6% to 12% APR, depending on creditworthiness.

- Loan Amounts: £2,000 to £40,000.

- Repayment Terms: Up to 10 years, with flexible repayment options during and after studies.

- Unique Features: Tailored loans for UK and international students, with quick approval processes.

- Eligibility: Students must be enrolled at a UK institution and provide proof of admission.

- Why Choose Future Finance: Its accessibility and competitive rates appeal to students needing smaller loan amounts.

- Home-Country Lenders

- Many international students secure loans from banks in their home countries, which may offer competitive rates or tax benefits (e.g., Indian banks like SBI or ICICI for Indian students).

- Interest Rates: Vary widely (e.g., 9.65% to 14% for Indian lenders).

- Eligibility: Typically requires collateral or a co-signer in the home country.

- Why Choose Home-Country Lenders: Familiarity with local banking systems and potential tax advantages make these loans appealing.

Key Considerations for UK Student Loans

- Limited Government Access: International students must explore private or home-country options, as UK government loans are largely unavailable.

- Graduate Route Visa: The UK’s Graduate Route visa allows international students to work for two to three years post-graduation, aiding loan repayment.

- Scholarships: Programs like Chevening and Commonwealth Scholarships can reduce loan dependency.

- Currency Fluctuations: International students should account for exchange rate risks when borrowing in their home currency.

Student Loan Options in Canada

Canada is a popular study destination due to its high-quality education and welcoming immigration policies. Tuition for international students can range from CAD 20,000 to 60,000 annually. Below, we outline the best student loan options in Canada.

Government Student Loans in Canada

The Canadian government offers loans through the Canada Student Loans Program (CSLP) for domestic students, with limited access for international students.

- Canada Student Loans: Provide up to CAD 210 per week of study for full-time students, with a mix of loans and grants based on financial need.

- Interest Rates: Interest-free during school; post-graduation rates are prime + 2.5% (floating) or prime + 5% (fixed).

- Repayment Terms: Standard repayment is 9.5 years, with options for income-driven repayment (Repayment Assistance Plan).

- Eligibility: Restricted to Canadian citizens, permanent residents, or protected persons.

- Benefits: Grants for low-income students and repayment assistance reduce financial burdens.

Private Student Loans in Canada

International students in Canada often turn to private lenders or international loan programs. Below are top options:

- MPOWER Financing

- Interest Rates: Fixed at 12.99% APR (13.98% with discounts).

- Loan Amounts: $2,001 to $100,000.

- Repayment Terms: 10 years, with interest-only payments starting 45 days after disbursement and a six-month grace period.

- Unique Features: No co-signer or collateral required, supports over 500 Canadian schools, and offers visa and career services.

- Eligibility: Students in their final two years of undergraduate or graduate programs at eligible institutions.

- Why Choose MPOWER: Its focus on academic potential and comprehensive support services make it a top choice for international students.

- Canadian Bank Loans

- Providers: Banks like RBC, TD, and Scotiabank offer student lines of credit, often requiring a Canadian co-signer.

- Interest Rates: Variable, typically prime + 1% to 5% (around 6% to 10% in 2025).

- Loan Amounts: Up to CAD 100,000, depending on the program and co-signer’s credit.

- Repayment Terms: Interest-only payments during school, with principal repayment starting post-graduation (up to 7 years).

- Eligibility: International students need a Canadian co-signer with good credit.

- Why Choose Bank Loans: Competitive rates and established banking relationships make these loans reliable for students with local support.

- Prodigy Finance

- Interest Rates: Variable, averaging 13.37% APR.

- Loan Amounts: Up to 100% of tuition and living expenses.

- Repayment Terms: 7 to 20 years, with a six-month grace period.

- Unique Features: No co-signer required, supports master’s programs at top Canadian schools.

- Eligibility: Master’s students in eligible programs.

- Why Choose Prodigy: Its no-cosigner model and flexible terms cater to international students pursuing advanced degrees.

Key Considerations for Canadian Student Loans

- Post-Graduation Work Permit (PGWP): Allows international students to work in Canada for up to three years, facilitating loan repayment.

- No-Cosigner Options: Lenders like MPOWER and Prodigy are critical for students without Canadian co-signers.

- Scholarships: Canadian universities offer merit- and need-based scholarships, reducing loan needs.

- Cost of Living: High living costs in cities like Toronto and Vancouver necessitate comprehensive loan coverage.

Comparing Student Loan Options Across the USA, UK, and Canada

To choose the best student loan options, students must compare key factors across countries:

- Interest Rates: U.S. federal loans offer fixed rates (6.39% to 8.94%), while private loans vary widely (2.95% to 17.99%). UK government loans have income-contingent rates (up to 7.3%), and private loans start at 6%. Canadian bank loans range from 6% to 10%, with international loans at 12.99% or higher.

- Eligibility: U.S. and Canadian federal loans are limited to citizens or eligible non-citizens, while UK loans exclude most international students. Private and no-cosigner loans are more accessible across all three countries.

- Repayment Flexibility: U.S. loans offer income-driven plans and forbearance, UK loans feature income-contingent repayment, and Canadian loans provide repayment assistance.

- Co-Signer Requirements: Common in U.S. and Canadian private loans but less so in the UK, where no-cosigner options like Prodigy Finance are prevalent.

- Loan Coverage: Most loans cover tuition and living expenses, but U.S. and Canadian loans often include books and transportation, while UK loans may be more restrictive.

Strategies to Minimize Student Loan Debt

Reducing reliance on student loans is critical for long-term financial health. Consider these strategies:

- Apply for Scholarships and Grants: Explore options like Fulbright (USA), Chevening (UK), and university-specific awards (Canada).

- Work Part-Time: U.S. students can work up to 20 hours per week on F-1 visas, UK students on Tier 4 visas, and Canadian students on study permits.

- Choose Affordable Schools: Public universities or community colleges in the USA and Canada often have lower tuition than private institutions.

- Budget Wisely: Create a detailed budget to manage living expenses and avoid over-borrowing.

- Consider Home-Country Loans: For international students, loans from home countries may offer tax benefits or lower rates.

Recommendations and Suggestions

To select the best student loan options in the USA, UK, and Canada, we recommend:

- Prioritize Federal Loans: If eligible, opt for U.S. or Canadian federal loans due to lower rates and flexible repayment.

- Explore No-Cosigner Loans: International students should consider MPOWER Financing and Prodigy Finance for their accessibility and focus on future potential.

- Compare Lenders: Use tools like Credible or InternationalStudentLoan.com to compare rates, terms, and eligibility.

- Apply Early: Loan processing can take weeks, so apply 3-6 months before classes start to secure funds and visa documentation.

- Seek Expert Advice: Consult financial advisors or university financial aid offices to tailor loan choices to your needs.

Frequently Asked Questions (FAQs)

- What are the best student loan options for international students in the USA?

Lenders like MPOWER Financing, Prodigy Finance, and Ascent Funding offer no-cosigner loans, while SoFi and Earnest provide competitive rates with a U.S. co-signer. - Can international students access UK government loans?

No, UK government loans are restricted to UK nationals and eligible EU students. International students should explore private lenders like Prodigy Finance. - What is the interest rate for federal student loans in the USA?

For 2025-2026, rates are approximately 6.39% for undergraduate Direct Loans and 8.94% for graduate PLUS Loans. - Do Canadian banks offer loans to international students?

Yes, banks like RBC and TD offer student lines of credit, but they typically require a Canadian co-signer. - What is a no-cosigner loan?

A no-cosigner loan does not require a guarantor, evaluating applicants based on academic potential and future earnings, ideal for international students. - How long is the grace period for U.S. private student loans?

Grace periods vary, with Earnest offering nine months and most others (e.g., SoFi, College Ave) offering six months. - Can I use student loans for living expenses?

Yes, most loans in the USA, UK, and Canada cover tuition, room and board, books, and other education-related expenses. - What is the repayment term for Prodigy Finance loans?

Prodigy Finance offers repayment terms of 7 to 20 years, with a six-month grace period post-graduation. - Are there scholarships to reduce loan dependency?

Yes, programs like Fulbright (USA), Chevening (UK), and university-specific awards (Canada) can offset costs. - How do I apply for a student loan?

Gather documents (admission letter, ID, academic records), compare lenders, and apply online, ensuring early submission to meet visa and funding deadlines. - What is the maximum loan amount for MPOWER Financing?

MPOWER offers loans from $2,001 to $100,000 for eligible students. - Do UK loans have income-contingent repayment?

Yes, UK government loans require repayments only if earning above £25,000 annually, with forgiveness after 30 years. - Can I work while studying to repay loans?

Yes, international students can work part-time (20 hours/week) in the USA, UK, and Canada under student visa regulations. - What happens if I can’t repay my loan?

Options include forbearance, deferment, or income-driven repayment plans, depending on the lender and country. - How do I choose the best student loan?

Compare interest rates, repayment terms, co-signer requirements, and additional benefits like career services or visa support.