Securing an education loan without collateral can be a game-changer for students aiming to pursue higher education without the burden of pledging assets. This comprehensive guide provides detailed insights into the process, eligibility criteria, documentation, and strategies to successfully obtain a non-collateral education loan. Whether you’re an Indian student eyeing prestigious institutions abroad or seeking funding for domestic studies, this article covers every aspect to help you navigate the application process seamlessly.

- Understanding Education Loans Without Collateral

- Who Can Apply for an Education Loan Without Collateral?

- Step-by-Step Process to Apply for an Education Loan Without Collateral

- Step 1: Research Lenders and Compare Options

- Step 2: Check Eligibility and Shortlist Lenders

- Step 3: Gather Required Documents

- Step 4: Fill Out the Loan Application

- Step 5: Submit the Application and Attend Interviews

- Step 6: Loan Sanction and Disbursal

- Tips to Strengthen Your Education Loan Application

- Benefits of Education Loans Without Collateral

- Challenges and How to Overcome Them

- Education Loan Without Collateral for International Studies

- Government Schemes Supporting Education Loans

- Repaying Your Education Loan Without Collateral

- Common Mistakes to Avoid

- How to Choose the Best Lender for an Education Loan Without Collateral

- Case Studies: Success Stories

- Recommendations and Suggestions

- Frequently Asked Questions (FAQs)

Understanding Education Loans Without Collateral

An education loan without collateral, also known as an unsecured education loan, is a financial product that does not require borrowers to pledge assets like property, fixed deposits, or other securities. These loans are particularly beneficial for students who lack substantial assets but aspire to study at top-tier institutions. Typically offered by banks, Non-Banking Financial Companies (NBFCs), and international lenders, these loans focus on the applicant’s academic profile, future earning potential, and creditworthiness.

Key Features of Non-Collateral Education Loans

-

No Asset Pledge: Unlike secured loans, these do not require collateral such as real estate or investments.

-

Higher Interest Rates: Due to the absence of security, interest rates may range from 10% to 16%, depending on the lender and applicant’s profile.

-

Flexible Repayment Terms: Repayment often begins after a moratorium period, typically 6-12 months post-course completion.

-

Loan Amount Limits: Amounts can range from ₹4 lakh to ₹40 lakh, depending on the course, institution, and lender policies.

-

Co-Applicant Requirement: Many lenders require a co-applicant (parent or guardian) with a stable income to strengthen the application.

Who Can Apply for an Education Loan Without Collateral?

Eligibility for an education loan without collateral varies by lender, but most institutions follow similar criteria to assess applicants. Understanding these requirements ensures a smoother application process.

Eligibility Criteria

-

Academic Background: Strong academic records, including high scores in qualifying exams (e.g., 10th, 12th, or undergraduate degree).

-

Admission Confirmation: Proof of admission to a recognized institution, either in India or abroad, in a professional or technical course (e.g., engineering, medicine, management).

-

Age Limit: Typically, applicants should be between 18 and 35 years old.

-

Co-Applicant’s Financial Stability: A co-applicant (usually a parent or guardian) with a steady income and good credit score strengthens the application.

-

Course and Institution: Loans are often approved for reputed institutions listed in lender-approved categories or with a strong placement history.

-

Nationality: Indian citizenship is mandatory for most Indian lenders, though some international lenders may have different policies.

Courses Eligible for Non-Collateral Loans

Lenders prioritize professional and technical courses with high employability. Eligible programs include:

-

Undergraduate degrees (e.g., B.Tech, MBBS, BBA)

-

Postgraduate degrees (e.g., MBA, MS, MD)

-

Diploma courses from reputed institutions

-

Vocational courses with strong job prospects

-

Study abroad programs in countries like the USA, UK, Canada, Australia, and Germany

Step-by-Step Process to Apply for an Education Loan Without Collateral

Navigating the application process for an education loan without collateral requires careful planning and attention to detail. Below is a detailed, step-by-step guide to ensure success.

Step 1: Research Lenders and Compare Options

Start by exploring lenders offering non-collateral education loans. In India, public sector banks, private banks, and NBFCs provide such loans, while international lenders cater to students studying abroad.

Public Sector Banks

-

State Bank of India (SBI): Offers the SBI Global Ed-Vantage Scheme with loans up to ₹20 lakh without collateral for select institutions.

-

Bank of Baroda: Provides the Baroda Scholar Scheme with competitive interest rates for unsecured loans.

-

Canara Bank: Known for flexible repayment options and loans up to ₹7.5 lakh without collateral.

Private Banks

-

HDFC Bank: Offers Credila Education Loans with quick disbursals and flexible terms.

-

ICICI Bank: Provides loans up to ₹40 lakh without collateral for premier institutions.

-

Axis Bank: Known for customized loan packages for students studying abroad.

NBFCs and International Lenders

-

Avanse Financial Services: Specializes in unsecured loans for both Indian and international courses.

-

InCred: Offers tailored education loans with minimal documentation.

-

Prodigy Finance: A popular choice for international students, with loans based on future earning potential.

-

MPower Financing: Focuses on students studying in the USA and Canada, with no co-applicant requirement.

Comparison Tips:

-

Check interest rates, processing fees, and repayment tenures.

-

Review the list of approved institutions and courses.

-

Assess additional benefits like grace periods or tax exemptions under Section 80E of the Income Tax Act.

Step 2: Check Eligibility and Shortlist Lenders

Once you identify potential lenders, verify your eligibility based on their criteria. Shortlist 2-3 lenders to compare loan terms and ensure alignment with your academic and financial profile.

Step 3: Gather Required Documents

Documentation is critical for a successful loan application. Prepare the following:

-

Academic Documents:

-

10th and 12th mark sheets

-

Undergraduate degree certificates (if applicable)

-

Entrance exam scorecards (e.g., JEE, NEET, GRE, GMAT)

-

Admission letter from the institution

-

-

Identity Proof:

-

Aadhaar card

-

PAN card

-

Passport (for international students)

-

-

Financial Documents:

-

Co-applicant’s income proof (salary slips, ITR for 2-3 years)

-

Bank statements (last 6-12 months)

-

Co-applicant’s credit report

-

-

Other Documents:

-

Loan application form

-

Passport-size photographs

-

Address proof (e.g., utility bill, rental agreement)

-

Statement of purpose (for international lenders)

-

Pro Tip: Organize documents in a folder and create digital copies for online submissions.

Step 4: Fill Out the Loan Application

Complete the lender’s application form accurately. Most lenders offer online applications through their websites or portals like Vidya Lakshmi (for Indian banks). Double-check details like course duration, loan amount, and co-applicant information.

Step 5: Submit the Application and Attend Interviews

Submit the application along with documents. Some lenders may require an interview to assess the applicant’s intent and repayment capability. Prepare to discuss your academic goals, course relevance, and career plans.

Step 6: Loan Sanction and Disbursal

Once approved, the lender issues a sanction letter outlining the loan amount, interest rate, and repayment terms. Review the terms carefully before signing the loan agreement. The loan is typically disbursed directly to the institution or in installments based on the course fee structure.

Tips to Strengthen Your Education Loan Application

A strong application increases your chances of securing an education loan without collateral. Consider these strategies:

-

Highlight Academic Excellence: Showcase high grades, awards, or scholarships to demonstrate your potential.

-

Choose Reputed Institutions: Lenders favor institutions with strong placement records, as they ensure repayment through future earnings.

-

Maintain a Good Credit Profile: Ensure the co-applicant has a clean credit history and stable income.

-

Apply Early: Submit applications well before the course start date to avoid delays.

-

Negotiate Terms: Discuss interest rates or repayment flexibility with the lender, especially if you have a strong profile.

-

Leverage Scholarships: Combine loans with scholarships to reduce the loan amount and improve approval chances.

Benefits of Education Loans Without Collateral

Opting for an unsecured education loan offers several advantages:

-

Accessibility: Ideal for students without assets to pledge.

-

Quick Processing: Many NBFCs and private banks offer faster approvals compared to secured loans.

-

Tax Benefits: Interest paid on education loans is tax-deductible under Section 80E in India.

-

Flexible Use: Funds can cover tuition, accommodation, travel, and other study-related expenses.

-

Moratorium Period: Repayment typically starts after course completion, easing financial pressure during studies.

Challenges and How to Overcome Them

While unsecured loans are attractive, they come with challenges:

-

Higher Interest Rates: Mitigate by comparing lenders and negotiating terms.

-

Limited Loan Amounts: Supplement with scholarships, part-time work, or parental support.

-

Stringent Eligibility: Strengthen your application with a robust academic and financial profile.

-

Co-Applicant Dependency: Ensure the co-applicant’s financial documents are in order to avoid rejection.

Education Loan Without Collateral for International Studies

For students planning to study abroad, non-collateral loans are a viable option. International lenders like Prodigy Finance and MPower Financing cater specifically to this segment, offering loans based on future earning potential rather than assets.

Key Considerations for International Loans

-

Currency and Exchange Rates: Loans are often disbursed in foreign currency, so account for exchange rate fluctuations.

-

Visa Requirements: Some lenders require a student visa before disbursal.

-

Institution Eligibility: Check if your chosen university is on the lender’s approved list.

-

Repayment in Foreign Currency: Plan for repayment in the currency of the loan to avoid conversion losses.

Popular International Lenders

-

Prodigy Finance:

-

Loans up to 100% of the cost of attendance.

-

No co-applicant or collateral required.

-

Repayment tenure up to 20 years.

-

-

MPower Financing:

-

Focuses on the USA and Canada.

-

Loans up to $100,000 without collateral.

-

Offers career support and networking opportunities.

-

Government Schemes Supporting Education Loans

In India, government initiatives like the Vidya Lakshmi Portal and Central Sector Interest Subsidy Scheme (CSIS) make education loans more accessible.

-

Vidya Lakshmi Portal: A single platform to apply for loans from multiple banks, simplifying the process.

-

CSIS: Provides interest subsidies during the moratorium period for students from economically weaker sections (income below ₹4.5 lakh per annum).

-

Dr. Ambedkar Central Sector Scheme: Offers interest subsidies for OBC and EBC students studying abroad.

Repaying Your Education Loan Without Collateral

Repaying an unsecured education loan requires strategic planning. Most lenders offer a moratorium period (course duration + 6-12 months), after which repayment begins.

Repayment Strategies

-

Start Early: Make small payments during the moratorium to reduce interest accumulation.

-

Choose the Right Tenure: Opt for a tenure that balances EMIs with your expected income.

-

Prepay When Possible: Use bonuses or extra income to prepay without penalties (check lender policies).

-

Monitor Interest Rates: If rates drop, consider refinancing with another lender.

-

Track Payments: Use online banking or lender portals to monitor EMI schedules and avoid defaults.

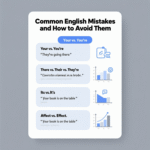

Common Mistakes to Avoid

-

Incomplete Documentation: Double-check all documents before submission.

-

Ignoring Fine Print: Read the loan agreement carefully to understand terms like prepayment penalties or late fees.

-

Overborrowing: Borrow only what you need to avoid excessive debt.

-

Missing Deadlines: Submit applications and repayments on time to maintain credibility.

-

Not Comparing Lenders: Explore multiple options to secure the best terms.

How to Choose the Best Lender for an Education Loan Without Collateral

Selecting the right lender is crucial for a hassle-free loan experience. Consider these factors:

-

Interest Rates: Compare fixed and floating rates across lenders.

-

Processing Fees: Look for minimal or waived fees.

-

Repayment Flexibility: Check for options like step-up EMIs or extended moratoriums.

-

Customer Support: Opt for lenders with responsive helplines or online portals.

-

Institution Tie-Ups: Some lenders have partnerships with universities, offering better terms.

Case Studies: Success Stories

Case Study 1: An MBA Aspirant

Rohan, a 24-year-old from Mumbai, secured admission to a top MBA program in the USA. Lacking collateral, he applied for a loan from Prodigy Finance. With a strong GMAT score (720) and a co-applicant with a good credit score, he secured a $50,000 loan at 11% interest. The loan covered tuition and living expenses, and Rohan repaid it within 7 years after landing a high-paying job.

Case Study 2: Engineering Student in India

Priya, a 19-year-old from Chennai, gained admission to an IIT for B.Tech. Her family lacked assets, so she applied for an SBI education loan without collateral. With her excellent JEE rank and her father’s stable income, she secured ₹10 lakh at 10.5% interest. The loan’s moratorium period allowed her to focus on studies, and she began repayments after joining a reputed IT firm.

Recommendations and Suggestions

To maximize your chances of securing an education loan without collateral:

-

Research extensively to find lenders with favorable terms.

-

Maintain a strong academic record to boost eligibility.

-

Ensure the co-applicant’s financial documents are robust.

-

Apply through platforms like Vidya Lakshmi for streamlined processing.

-

Seek professional advice from financial advisors if needed.

-

Combine loans with scholarships or part-time work to reduce financial strain.

-

Stay updated on government schemes like CSIS for additional benefits.

Frequently Asked Questions (FAQs)

-

What is an education loan without collateral?

An education loan without collateral is an unsecured loan that does not require pledging assets, based on the applicant’s academic profile and co-applicant’s financial stability. -

Who is eligible for a non-collateral education loan?

Students with strong academic records, admission to recognized institutions, and a co-applicant with stable income are eligible. -

Which banks offer education loans without collateral in India?

SBI, Bank of Baroda, ICICI Bank, HDFC Bank, and NBFCs like Avanse and InCred offer such loans. -

Can I get a non-collateral loan for international studies?

Yes, lenders like Prodigy Finance and MPower Financing offer unsecured loans for international students. -

What is the maximum loan amount without collateral?

It varies by lender, typically ranging from ₹4 lakh to ₹40 lakh in India and up to $100,000 for international lenders. -

What documents are required for a non-collateral education loan?

Academic records, admission letter, identity proof, co-applicant’s income proof, and bank statements are needed. -

Are interest rates higher for non-collateral loans?

Yes, rates range from 10% to 16% due to the absence of security. -

Can I get tax benefits on education loans?

Yes, interest paid is deductible under Section 80E of the Income Tax Act in India. -

What is the moratorium period for education loans?

It typically includes the course duration plus 6-12 months post-completion. -

Can I prepay my education loan without penalties?

Most lenders allow prepayment without penalties, but check the loan agreement. -

What happens if I default on my education loan?

Defaulting can damage your credit score and lead to legal action by the lender. -

Can I apply for a loan without a co-applicant?

Some international lenders like Prodigy Finance don’t require a co-applicant, but most Indian lenders do. -

How long does the loan approval process take?

It typically takes 7-15 days, depending on the lender and documentation. -

Can I use the loan for expenses other than tuition?

Yes, it can cover accommodation, travel, books, and other study-related costs. -

How do I apply for government interest subsidies?

Apply through schemes like CSIS or Dr. Ambedkar Scheme via the Vidya Lakshmi Portal, with income proof.