The stock market is a dynamic and powerful platform where individuals can build wealth, achieve financial independence, and participate in the global economy. For students, understanding the stock market basics can be a transformative step toward financial literacy and long-term prosperity. This in-depth guide provides a clear, detailed, and engaging exploration of the stock market, tailored specifically for students. We aim to demystify complex concepts, offer actionable insights, and equip young investors with the knowledge to navigate the world of investing confidently.

- What Is the Stock Market?

- Key Stock Market Terms Every Student Should Know

- Why Investing Early Matters for Students

- How to Start Investing as a Student

- Step 1: Set Clear Financial Goals

- Step 2: Open a Brokerage Account

- Step 3: Start Small with Fractional Shares

- Step 4: Diversify Your Investments

- Step 5: Stay Informed and Patient

- Types of Investments in the Stock Market

- Understanding Stock Market Risks

- Strategies for Successful Investing

- Tools and Resources for Student Investors

- Common Mistakes to Avoid in the Stock Market

- The Role of Financial Education in Investing

- Building a Long-Term Investment Mindset

- Stock Market Myths Debunked

- The Impact of Technology on the Stock Market

- Ethical Investing for Students

- The Global Stock Market: Opportunities for Students

- How to Analyze Stocks

- The Role of Dividends in Wealth Building

- Tax Considerations for Student Investors

- The Psychology of Investing

- Stock Market Trends to Watch

- Building a Stock Market Study Plan

- Stock Market for Students: Real-Life Examples

- Recommendations and Suggestions

- Frequently Asked Questions (FAQs)

What Is the Stock Market?

The stock market is a marketplace where buyers and sellers trade shares of publicly listed companies. These shares represent ownership in a company, and their value fluctuates based on supply, demand, and various economic factors. For students, the stock market offers an opportunity to grow savings over time, whether for short-term goals like funding education or long-term aspirations like retirement.

How Does the Stock Market Work?

At its core, the stock market operates through exchanges like the New York Stock Exchange (NYSE) or Nasdaq, where companies list their shares for public purchase. When a company goes public, it issues shares through an Initial Public Offering (IPO), allowing investors to buy a stake in its future growth. These shares are then traded on the open market, with prices influenced by:

-

Company performance: Strong earnings reports or innovative products can drive share prices higher.

-

Market sentiment: Investor confidence or economic news impacts demand.

-

Global events: Political stability, interest rates, or natural disasters can sway markets.

For students, understanding this interplay is crucial. By investing in a company’s stock, you’re betting on its ability to generate profits and increase its value over time.

Why Should Students Care About the Stock Market?

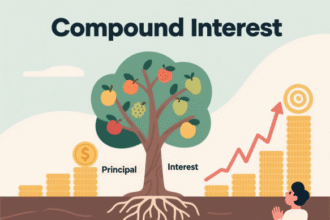

Investing early offers students a unique advantage: time. The power of compound interest allows even small investments to grow significantly over decades. For example, investing $100 at age 20 with an average annual return of 7% could grow to over $1,400 by age 60. Beyond wealth-building, engaging with the stock market fosters financial discipline, sharpens analytical skills, and prepares students for real-world economic challenges.

Key Stock Market Terms Every Student Should Know

To navigate the stock market, students must grasp essential terminology. Below, we outline critical concepts to build a strong foundation:

-

Stocks: Shares of ownership in a company. Owning stock means you own a piece of the company’s assets and future profits.

-

Dividends: Payments made by a company to its shareholders, typically from profits, as a reward for holding stock.

-

Bull Market: A period when stock prices are rising, reflecting investor optimism.

-

Bear Market: A period when stock prices are declining, often tied to economic downturns.

-

Portfolio: A collection of investments, including stocks, bonds, or other assets, owned by an individual.

-

Brokerage Account: An account with a financial institution that allows you to buy and sell stocks.

-

Market Order: An instruction to buy or sell a stock immediately at the current market price.

-

Limit Order: An instruction to buy or sell a stock at a specific price or better.

Mastering these terms empowers students to make informed decisions and communicate confidently in financial discussions.

Why Investing Early Matters for Students

The stock market offers students a unique opportunity to harness time and compound interest. Starting early allows even modest investments to grow substantially. Consider this example:

-

A student invests $500 at age 18 in a diversified stock portfolio with an average annual return of 8%.

-

By age 65, assuming consistent contributions of $50 per month, the portfolio could grow to over $400,000.

This growth stems from compound interest, where returns generate additional returns over time. For students, starting small—whether through a part-time job or allowance—can yield significant results.

Benefits of Early Investing

-

Financial Independence: Early investments create a safety net for future expenses, such as buying a home or starting a business.

-

Learning Through Experience: Navigating the stock market teaches critical thinking, risk management, and patience.

-

Beating Inflation: Stocks historically outpace inflation, preserving and growing purchasing power.

By starting now, students can develop habits that lead to lifelong financial success.

How to Start Investing as a Student

Getting started in the stock market doesn’t require significant capital or expertise. With modern tools and platforms, students can begin investing with as little as $10. Here’s a step-by-step guide to launching your investment journey:

Step 1: Set Clear Financial Goals

Before investing, define your objectives. Are you saving for college, a car, or long-term wealth? Clear goals guide your investment strategy and risk tolerance. For example:

-

Short-term goals (1–3 years): Focus on low-risk investments like bonds or high-yield savings accounts.

-

Long-term goals (5+ years): Stocks or mutual funds offer higher growth potential.

Step 2: Open a Brokerage Account

To buy stocks, you’ll need a brokerage account. Many platforms cater to beginners, offering low fees and user-friendly interfaces. Popular options include:

-

Robinhood: Commission-free trading with a simple mobile app.

-

Fidelity: Robust research tools and no minimum balance for students.

-

Charles Schwab: Low-cost investing with strong customer support.

For students under 18, consider a custodial account, managed by a parent or guardian, which transitions to your control at adulthood.

Step 3: Start Small with Fractional Shares

Many platforms allow you to buy fractional shares, enabling investment in expensive stocks like Apple or Amazon with minimal funds. For example, if a stock costs $200 per share, you can invest $20 to own a fraction.

Step 4: Diversify Your Investments

Diversification reduces risk by spreading investments across various assets. Instead of betting on a single stock, consider:

-

Index Funds: Track broad market indices like the S&P 500, offering instant diversification.

-

Exchange-Traded Funds (ETFs): Similar to index funds but trade like stocks.

-

Sector Funds: Focus on specific industries, like technology or healthcare.

Step 5: Stay Informed and Patient

The stock market rewards patience and knowledge. Follow market news, read company reports, and avoid impulsive decisions based on short-term fluctuations. Apps like Yahoo Finance or Bloomberg provide real-time updates and educational resources.

Types of Investments in the Stock Market

The stock market offers various investment vehicles, each with unique risks and rewards. Understanding these options helps students build a balanced portfolio.

Common Stocks

These represent ownership in a company and typically come with voting rights. Common stocks offer:

-

Growth Potential: Share prices rise with company success.

-

Dividends: Some companies pay regular dividends, providing income.

However, common stocks carry higher risk, as prices can drop significantly during market downturns.

Preferred Stocks

Preferred stocks offer fixed dividends and priority over common shareholders in case of bankruptcy. They’re less volatile but offer limited growth compared to common stocks.

Mutual Funds

Mutual funds pool money from multiple investors to buy a diversified portfolio of stocks, bonds, or other assets. Benefits include:

-

Professional Management: Fund managers make investment decisions.

-

Diversification: Exposure to a broad range of companies.

-

Accessibility: Low minimum investments, ideal for students.

Exchange-Traded Funds (ETFs)

ETFs combine the flexibility of stocks with the diversification of mutual funds. They’re cost-effective and track indices, sectors, or commodities. Popular ETFs include:

-

SPY: Tracks the S&P 500.

-

QQQ: Focuses on technology-heavy Nasdaq stocks.

Bonds

While not stocks, bonds are often part of a balanced portfolio. They represent loans to companies or governments, offering fixed interest payments. Bonds are safer but typically yield lower returns than stocks.

Understanding Stock Market Risks

Investing involves risks, and students must understand potential pitfalls to make informed decisions. Key risks include:

-

Market Risk: Stock prices can decline due to economic downturns or geopolitical events.

-

Company-Specific Risk: Poor management or product failures can harm individual stocks.

-

Liquidity Risk: Some stocks may be hard to sell quickly without losing value.

To mitigate risks, students should:

-

Diversify across industries and asset types.

-

Invest only what they can afford to lose.

-

Focus on long-term growth rather than short-term gains.

Strategies for Successful Investing

Adopting proven strategies enhances your chances of success in the stock market. Below are approaches tailored for students:

Dollar-Cost Averaging

This strategy involves investing a fixed amount regularly, regardless of market conditions. For example, investing $50 monthly in an ETF reduces the impact of market volatility by spreading purchases over time.

Value Investing

Value investors seek undervalued stocks with strong fundamentals, such as low price-to-earnings (P/E) ratios. This approach, popularized by Warren Buffett, requires research but can yield significant returns.

Growth Investing

Growth investors focus on companies with high potential for future earnings, such as tech startups. These stocks are riskier but offer substantial growth opportunities.

Dividend Investing

Dividend stocks provide regular income, which can be reinvested to compound returns. Look for companies with a history of consistent dividend payments, like Coca-Cola or Johnson & Johnson.

Tools and Resources for Student Investors

Technology has made investing more accessible than ever. Students can leverage these tools to stay informed and manage investments:

-

Investment Apps: Robinhood, Acorns, and Stash offer beginner-friendly platforms with low or no fees.

-

Financial News: Websites like CNBC, MarketWatch, and The Wall Street Journal provide market insights.

-

Stock Simulators: Platforms like Investopedia’s Stock Simulator allow students to practice trading without risking real money.

-

Educational Resources: Books like The Intelligent Investor by Benjamin Graham or A Random Walk Down Wall Street by Burton Malkiel offer timeless advice.

Common Mistakes to Avoid in the Stock Market

New investors often make avoidable errors. Here are pitfalls to steer clear of:

-

Chasing Trends: Investing based on hype, like meme stocks, can lead to losses.

-

Lack of Research: Buying stocks without understanding the company’s fundamentals is risky.

-

Emotional Decisions: Panic-selling during market dips locks in losses.

-

Overtrading: Frequent buying and selling incurs fees and disrupts long-term growth.

By staying disciplined and informed, students can avoid these traps and build a solid investment foundation.

The Role of Financial Education in Investing

Financial literacy is the cornerstone of successful investing. Students should prioritize learning about:

-

Budgeting: Managing personal finances ensures funds are available for investing.

-

Economic Indicators: Understanding GDP, inflation, and interest rates provides context for market movements.

-

Tax Implications: Knowing how capital gains taxes work helps maximize returns.

Many universities offer free financial literacy workshops, and online platforms like Coursera or Khan Academy provide accessible courses.

Building a Long-Term Investment Mindset

The stock market is a marathon, not a sprint. Students should focus on:

-

Consistency: Regular investments, even small ones, add up over time.

-

Patience: Markets fluctuate, but long-term trends historically trend upward.

-

Continuous Learning: Staying updated on market trends and strategies sharpens decision-making.

By adopting this mindset, students can turn modest beginnings into substantial wealth.

Stock Market Myths Debunked

Misconceptions can deter students from investing. Let’s address common myths:

-

Myth: You Need a Lot of Money to Invest

Reality: Fractional shares and low-cost platforms allow investing with minimal funds. -

Myth: The Stock Market Is Like Gambling

Reality: Informed investing based on research and diversification is a calculated strategy, not a game of chance. -

Myth: Only Experts Can Succeed

Reality: Beginners can succeed with education, patience, and disciplined strategies.

The Impact of Technology on the Stock Market

Technology has revolutionized investing, making it more accessible for students. Key advancements include:

-

Robo-Advisors: Platforms like Betterment or Wealthfront automate portfolio management based on your goals and risk tolerance.

-

Algorithmic Trading: High-frequency trading influences market dynamics, though students should focus on long-term strategies.

-

Financial Apps: Mobile apps provide real-time data, portfolio tracking, and educational resources.

Embracing these tools empowers students to make informed decisions efficiently.

Ethical Investing for Students

Many students prioritize social responsibility. Ethical investing, such as ESG (Environmental, Social, Governance) funds, aligns investments with values like sustainability or diversity. For example, ESG funds avoid companies with poor environmental records or unethical practices, offering both financial and moral returns.

The Global Stock Market: Opportunities for Students

The stock market isn’t limited to one country. Students can invest in international markets to diversify and tap into global growth. For example:

-

Emerging Markets: Countries like India or Brazil offer high growth potential but carry higher risks.

-

Developed Markets: Europe and Japan provide stability and established companies.

Platforms like Interactive Brokers allow access to global exchanges, broadening investment opportunities.

How to Analyze Stocks

Analyzing stocks is critical for informed investing. Students can use two primary methods:

Fundamental Analysis

This involves evaluating a company’s financial health through:

-

Earnings Per Share (EPS): Measures profitability per share.

-

Price-to-Earnings (P/E) Ratio: Compares stock price to earnings, indicating if a stock is over- or undervalued.

-

Balance Sheet: Assesses assets, liabilities, and equity to gauge stability.

Technical Analysis

Technical analysis studies price patterns and market trends using:

-

Moving Averages: Smooth out price data to identify trends.

-

Relative Strength Index (RSI): Measures momentum to determine if a stock is overbought or oversold.

Students can access free tools like TradingView to practice technical analysis.

The Role of Dividends in Wealth Building

Dividends are a powerful tool for students. Reinvesting dividends compounds returns over time. For example, a $1,000 investment in a stock with a 3% dividend yield, reinvested annually, could grow significantly over decades. Look for Dividend Aristocrats—companies with 25+ years of consistent dividend increases—for stability.

Tax Considerations for Student Investors

Understanding taxes is essential. In the U.S., key tax concepts include:

-

Capital Gains Tax: Profits from selling stocks are taxed as short-term (held less than a year) or long-term (held over a year), with long-term rates typically lower.

-

Dividend Tax: Dividends are taxed as ordinary income or qualified dividends, depending on holding period.

-

Tax-Advantaged Accounts: Consider Roth IRAs for tax-free growth, especially for students with earned income.

Consult a tax professional to optimize your strategy.

The Psychology of Investing

Emotions can derail even the best investment plans. Common psychological traps include:

-

Fear of Missing Out (FOMO): Chasing hot stocks leads to impulsive decisions.

-

Loss Aversion: Holding losing stocks too long in hopes of recovery.

-

Overconfidence: Overestimating your knowledge can lead to risky bets.

Sticking to a disciplined plan and focusing on long-term goals helps manage these biases.

Stock Market Trends to Watch

Students should stay aware of trends shaping the market, such as:

-

Artificial Intelligence (AI): Companies like NVIDIA and Microsoft are driving AI innovation, creating investment opportunities.

-

Renewable Energy: Growth in solar, wind, and electric vehicles offers long-term potential.

-

Biotechnology: Advances in healthcare, like gene editing, are high-risk, high-reward opportunities.

Following these trends helps students identify promising sectors.

Building a Stock Market Study Plan

To master the stock market, students should create a structured study plan:

-

Learn the Basics: Read introductory books or take online courses.

-

Follow Markets: Track indices like the Dow Jones or S&P 500 daily.

-

Practice with Simulators: Use virtual trading platforms to test strategies.

-

Join Investment Clubs: Many universities offer clubs to discuss and practice investing.

-

Stay Updated: Subscribe to financial newsletters or podcasts like The Motley Fool.

Consistency in learning builds expertise over time.

Stock Market for Students: Real-Life Examples

Consider these success stories to inspire your journey:

-

Warren Buffett: Started investing at age 11, building a fortune through disciplined value investing.

-

Student Investors: Many college students use platforms like Robinhood to grow small investments into significant savings by graduation.

These examples show that starting early and staying committed can yield remarkable results.

Recommendations and Suggestions

To succeed in the stock market, students should:

-

Start with small, regular investments to build confidence.

-

Prioritize low-cost, diversified options like ETFs or index funds.

-

Use reputable platforms with low fees and strong educational resources.

-

Stay patient and avoid emotional decisions during market volatility.

-

Continuously educate yourself through books, podcasts, and financial news.

By following these steps, students can lay the foundation for a financially secure future.

Frequently Asked Questions (FAQs)

-

What is the stock market?

The stock market is a platform where shares of companies are bought and sold, reflecting their value based on supply, demand, and economic factors. -

Can students invest in the stock market?

Yes, students can invest through brokerage accounts or custodial accounts if under 18, often starting with small amounts. -

How much money do I need to start investing?

You can start with as little as $10 using platforms that offer fractional shares. -

What are the risks of investing in stocks?

Risks include market volatility, company-specific issues, and economic downturns, but diversification can mitigate these. -

What is compound interest?

Compound interest is the process of earning returns on both your initial investment and the returns it generates over time. -

What are fractional shares?

Fractional shares allow you to buy a portion of a stock, making expensive stocks accessible with small investments. -

What is a brokerage account?

A brokerage account is a financial account that lets you buy and sell stocks, ETFs, and other investments. -

Should I invest all my money in one stock?

No, diversification across multiple stocks or funds reduces risk. -

What are index funds?

Index funds are mutual funds or ETFs that track a market index, like the S&P 500, offering broad diversification. -

How do I research stocks?

Use fundamental analysis (e.g., P/E ratio, earnings reports) and technical analysis (e.g., price charts) to evaluate stocks. -

What is a dividend?

A dividend is a payment made by a company to its shareholders, typically from profits. -

Can I lose all my money in the stock market?

While possible, diversification and long-term investing reduce the likelihood of total loss. -

What is a bull market?

A bull market is a period of rising stock prices, reflecting investor optimism. -

What is a bear market?

A bear market is a period of declining stock prices, often tied to economic challenges. -

How can I stay informed about the stock market?

Follow financial news, use apps like Yahoo Finance, and read educational resources to stay updated.