Mutual funds offer a powerful way to build wealth, diversify investments, and achieve financial goals. For beginners, navigating the world of mutual funds can seem daunting, but with the right knowledge, it becomes an accessible and rewarding endeavor. This guide provides a detailed roadmap to understanding mutual funds, their benefits, risks, and strategies to maximize returns. We aim to equip novice investors with the tools to make informed decisions and confidently embark on their investment journey.

- What Are Mutual Funds?

- Why Invest in Mutual Funds?

- Types of Mutual Funds

- How to Start Investing in Mutual Funds

- Step 1: Define Financial Goals

- Step 2: Assess Risk Tolerance

- Step 3: Research and Select Funds

- Step 4: Open an Investment Account

- Step 5: Start with Systematic Investment Plans (SIPs)

- Step 6: Monitor and Rebalance

- Understanding Mutual Fund Costs

- Tax Implications of Mutual Funds

- Strategies for Successful Mutual Fund Investing

- Diversify Across Fund Types

- Invest for the Long Term

- Use Dollar-Cost Averaging

- Stay Informed

- Avoid Emotional Investing

- Common Mistakes to Avoid

- Tools and Resources for Mutual Fund Investors

- Building a Mutual Fund Portfolio

- Advanced Mutual Fund Strategies

- The Role of Mutual Funds in Retirement Planning

- Global Trends in Mutual Fund Investing

- How to Evaluate Mutual Fund Performance

- Mutual Funds vs. Other Investment Options

- The Future of Mutual Fund Investing

- Suggestions and Recommendations

- Frequently Asked Questions (FAQs)

What Are Mutual Funds?

Mutual funds pool money from multiple investors to purchase a diversified portfolio of securities, such as stocks, bonds, or other assets. Managed by professional fund managers, these funds allow individuals to invest in a broad range of assets without needing to select individual securities. Each investor owns shares of the mutual fund, proportional to their investment, and benefits from the fund’s performance.

Key Features of Mutual Funds

-

Diversification: Spreads risk across various assets, reducing the impact of a single security’s poor performance.

-

Professional Management: Experienced fund managers make investment decisions based on research and market analysis.

-

Accessibility: Investors can start with small amounts, making mutual funds suitable for beginners.

-

Liquidity: Most mutual funds allow investors to buy or sell shares on any business day.

-

Variety: Options include equity, debt, hybrid, and sector-specific funds, catering to different risk appetites and goals.

Why Invest in Mutual Funds?

Investing in mutual funds offers several advantages, particularly for beginners seeking a low-maintenance, diversified investment vehicle. Here’s why mutual funds are a smart choice:

Benefits of Mutual Funds

-

Diversification Reduces Risk: By investing in a basket of securities, mutual funds minimize the impact of any single asset’s failure. For example, an equity mutual fund might hold stocks from technology, healthcare, and consumer goods sectors, balancing potential losses.

-

Professional Expertise: Fund managers with extensive market knowledge handle investment decisions, saving beginners the effort of researching individual stocks or bonds.

-

Low Entry Barriers: Many mutual funds have low minimum investment requirements, some as low as $100, making them accessible to new investors.

-

Flexibility: Investors can choose funds aligning with their financial goals, whether short-term savings or long-term wealth creation.

-

Cost Efficiency: Mutual funds benefit from economies of scale, reducing transaction costs compared to buying individual securities.

-

Systematic Investment Plans (SIPs): SIPs allow investors to contribute small, regular amounts, fostering disciplined investing and reducing the impact of market volatility.

Potential Drawbacks

While mutual funds are advantageous, they come with risks and costs:

-

Fees and Expenses: Management fees, expense ratios, and load fees can erode returns. Beginners should seek low-cost funds to maximize gains.

-

Market Risk: Like all investments, mutual funds are subject to market fluctuations, and returns are not guaranteed.

-

Limited Control: Investors rely on fund managers’ decisions, which may not always align with personal preferences.

Types of Mutual Funds

Understanding the types of mutual funds is crucial for selecting the right investment. Funds vary based on asset class, investment strategy, and risk level.

Equity Mutual Funds

Equity funds invest primarily in stocks, aiming for capital appreciation. They are ideal for long-term goals like retirement or wealth creation but carry higher risk due to market volatility.

-

Large-Cap Funds: Invest in well-established companies with stable earnings, offering lower risk and steady growth.

-

Mid-Cap Funds: Focus on medium-sized companies with growth potential, balancing risk and reward.

-

Small-Cap Funds: Target smaller companies with high growth potential but increased volatility.

-

Sector Funds: Concentrate on specific industries, such as technology or healthcare, suitable for investors with strong sector convictions.

Debt Mutual Funds

Debt funds invest in fixed-income securities like government bonds, corporate bonds, or treasury bills. They offer stability and lower risk, making them suitable for conservative investors.

-

Liquid Funds: Invest in short-term instruments like treasury bills, ideal for emergency funds or short-term goals.

-

Bond Funds: Focus on longer-term bonds, providing regular income and moderate risk.

-

Gilt Funds: Invest in government securities, offering safety but lower returns.

Hybrid Mutual Funds

Hybrid funds combine equities and debt, balancing growth and stability. They suit investors seeking moderate risk and diversified exposure.

-

Balanced Funds: Maintain a fixed ratio of equity and debt, typically 60:40.

-

Dynamic Asset Allocation Funds: Adjust equity-debt ratios based on market conditions, offering flexibility.

-

Multi-Asset Funds: Invest in equities, debt, and other assets like gold, providing broad diversification.

Other Types of Mutual Funds

-

Index Funds: Track market indices like the S&P 500, offering low costs and predictable performance.

-

Exchange-Traded Funds (ETs): Trade like stocks on exchanges, combining mutual fund benefits with liquidity.

-

International Funds: Invest in foreign markets, adding global diversification but with currency and geopolitical risks.

-

Fund of Funds (FoFs): Invest in other mutual funds, offering diversification but higher fees.

How to Start Investing in Mutual Funds

For beginners, starting with mutual funds involves a step-by-step process. Here’s a detailed guide to get started:

Step 1: Define Financial Goals

Identify your investment objectives, such as saving for a house, retirement, or education. Goals determine the type of mutual fund and investment horizon.

-

Short-Term Goals (1-3 years): Opt for debt or liquid funds for stability.

-

Medium-Term Goals (3-5 years): Consider hybrid or balanced funds for moderate growth.

-

Long-Term Goals (5+ years): Equity funds are ideal for wealth creation.

Step 2: Assess Risk Tolerance

Evaluate your comfort with market fluctuations. Younger investors with longer horizons can typically tolerate higher risk, while those nearing retirement may prefer conservative options.

Step 3: Research and Select Funds

Use the following criteria to choose mutual funds:

-

Performance History: Review 3-5 year returns, but remember past performance doesn’t guarantee future results.

-

Expense Ratio: Lower fees (e.g., below 1%) maximize returns.

-

Fund Manager Track Record: Check the manager’s experience and consistency.

-

Fund House Reputation: Choose reputable asset management companies with a strong history.

Step 4: Open an Investment Account

Invest through:

-

Mutual Fund Companies: Directly via their websites or offices.

-

Online Platforms: Brokerages or apps like Vanguard, Fidelity, or robo-advisors.

-

Financial Advisors: For personalized guidance, though fees may apply.

Step 5: Start with Systematic Investment Plans (SIPs)

SIPs allow investing fixed amounts regularly (e.g., monthly). Benefits include:

-

Rupee Cost Averaging: Reduces the impact of market volatility by buying more units when prices are low.

-

Discipline: Encourages consistent investing, ideal for beginners.

-

Flexibility: Start with as little as $10-$50 monthly.

Step 6: Monitor and Rebalance

Regularly review your portfolio to ensure it aligns with goals and risk tolerance. Rebalance annually or when significant life changes occur.

Understanding Mutual Fund Costs

Costs impact returns, so understanding fees is essential for beginners.

Types of Fees

-

Expense Ratio: Annual fee for fund management, typically 0.5%-2%. Index funds often have lower ratios (e.g., 0.1%).

-

Load Fees: Sales charges when buying (front-end) or selling (back-end) shares. No-load funds are preferable for cost savings.

-

Transaction Fees: Charged for buying or selling shares, varying by platform.

-

12b-1 Fees: Marketing and distribution costs, included in the expense ratio.

How to Minimize Costs

-

Choose no-load funds to avoid sales charges.

-

Opt for funds with low expense ratios, especially index funds.

-

Invest directly through fund companies to reduce intermediary fees.

-

Avoid frequent trading to minimize transaction costs.

Tax Implications of Mutual Funds

Mutual fund investments have tax consequences that beginners should understand.

Types of Taxes

-

Capital Gains Tax: Applies when selling fund shares at a profit. Short-term gains (held <1 year) are taxed as ordinary income; long-term gains (held >1 year) have lower rates.

-

Dividend Tax: Dividends from funds are taxed as ordinary income unless qualified, which may have lower rates.

-

Tax-Advantaged Accounts: Investing through IRAs or 401(k)s can defer or eliminate taxes on gains and dividends.

Tax-Efficient Strategies

-

Hold funds in tax-advantaged accounts like Roth IRAs for tax-free growth.

-

Choose tax-efficient funds, like index funds, with low turnover to minimize capital gains distributions.

-

Consider tax-loss harvesting to offset gains with losses.

Strategies for Successful Mutual Fund Investing

To maximize returns and minimize risks, adopt these strategies:

Diversify Across Fund Types

Spread investments across equity, debt, and hybrid funds to balance risk and reward. For example, allocate 60% to equity funds, 30% to debt funds, and 10% to hybrid funds for a balanced portfolio.

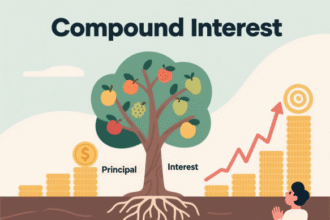

Invest for the Long Term

Mutual funds perform best over extended periods due to compounding. A $10,000 investment in an equity fund with a 7% annual return could grow to $19,671 in 10 years.

Use Dollar-Cost Averaging

Investing fixed amounts regularly through SIPs reduces the risk of buying at peak prices and smooths out market volatility.

Stay Informed

Keep abreast of market trends, economic indicators, and fund performance. Use resources like Morningstar or fund company reports for insights.

Avoid Emotional Investing

Market fluctuations can tempt investors to sell during downturns. Stick to your long-term plan to avoid locking in losses.

Common Mistakes to Avoid

Beginners often make errors that can hinder success. Avoid these pitfalls:

-

Chasing Performance: Selecting funds based solely on recent high returns can lead to buying at peak prices.

-

Ignoring Fees: High expense ratios erode returns over time. Always compare fees before investing.

-

Over-Diversification: Holding too many funds can dilute returns and complicate management.

-

Timing the Market: Trying to predict market movements often leads to missed opportunities. Focus on consistent investing.

-

Neglecting Goals: Misaligning funds with financial objectives can derail plans. Match funds to your investment horizon.

Tools and Resources for Mutual Fund Investors

Leverage these tools to enhance your investment journey:

-

Morningstar: Offers fund ratings, performance data, and analysis tools.

-

Yahoo Finance: Provides market news and fund comparisons.

-

Fund Company Websites: Access prospectuses, fact sheets, and performance reports.

-

Robo-Advisors: Platforms like Betterment or Wealthfront automate portfolio management for beginners.

-

Financial Advisors: Seek certified planners for personalized advice, especially for complex portfolios.

Building a Mutual Fund Portfolio

Constructing a portfolio involves balancing risk, return, and goals. Here’s a sample allocation for a beginner with a moderate risk tolerance:

-

60% Equity Funds: 30% large-cap, 20% mid-cap, 10% small-cap.

-

30% Debt Funds: 20% bond funds, 10% liquid funds.

-

10% Hybrid Funds: Balanced or dynamic allocation funds.

Adjust allocations based on age, income, and goals. For example, younger investors might increase equity exposure to 80%, while retirees may favor 60% debt funds.

Advanced Mutual Fund Strategies

As you gain experience, consider these advanced approaches:

Tax-Loss Harvesting

Sell funds at a loss to offset capital gains, reducing tax liability. Reinvest proceeds in similar funds to maintain portfolio balance.

Sector Rotation

Shift investments to sectors expected to outperform based on economic cycles, such as technology during growth phases or utilities during recessions.

Rebalancing

Periodically adjust your portfolio to maintain desired asset allocation. For example, if equity funds grow to 70% of your portfolio, sell some shares and reinvest in debt funds to restore a 60:40 ratio.

Dividend Reinvestment

Reinvest dividends to purchase additional fund shares, accelerating compounding and growth.

The Role of Mutual Funds in Retirement Planning

Mutual funds are a cornerstone of retirement portfolios due to their diversification and long-term growth potential. For example:

-

Target-Date Funds: Automatically adjust asset allocation as you approach retirement, shifting from equities to bonds.

-

Dividend Funds: Provide regular income for retirees, supplementing pensions or Social Security.

-

Balanced Funds: Offer stability and growth for those nearing retirement.

Contribute to mutual funds through 401(k)s or IRAs to maximize tax benefits and build a robust retirement nest egg.

Global Trends in Mutual Fund Investing

The mutual fund industry evolves with economic and technological trends. Key developments include:

-

Rise of ESG Funds: Environmental, Social, and Governance (ESG) funds focus on sustainable and ethical investments, appealing to socially conscious investors.

-

Growth of Passive Investing: Index funds and ETFs have surged in popularity due to low costs and consistent performance.

-

Digital Platforms: Online brokerages and apps make investing more accessible, with user-friendly interfaces and low fees.

-

Global Diversification: International and emerging market funds gain traction as investors seek exposure to growing economies.

How to Evaluate Mutual Fund Performance

Assessing fund performance goes beyond raw returns. Consider these metrics:

-

Annualized Returns: Measure average yearly performance over 3-5 years for consistency.

-

Risk-Adjusted Returns: Use metrics like Sharpe Ratio to evaluate returns relative to risk.

-

Benchmark Comparison: Compare fund performance to relevant indices, like the S&P 500 for equity funds.

-

Consistency: Look for steady performance across market cycles, not just short-term spikes.

Mutual Funds vs. Other Investment Options

Compare mutual funds with alternatives to make informed choices:

-

Stocks: Offer higher potential returns but require active management and carry higher risk.

-

Bonds: Provide stability but lower returns compared to equity mutual funds.

-

ETFs: Similar to mutual funds but trade like stocks, offering intraday liquidity.

-

Real Estate: Offers tangible assets but requires significant capital and management.

-

Savings Accounts: Safe but yield low returns, unsuitable for long-term growth.

Mutual funds strike a balance between accessibility, diversification, and growth potential, making them ideal for beginners.

The Future of Mutual Fund Investing

The mutual fund landscape is evolving with technology and investor preferences. Expect:

-

Increased Automation: Robo-advisors and AI-driven platforms will simplify fund selection and portfolio management.

-

Personalized Funds: Customizable funds tailored to individual goals and risk profiles may emerge.

-

Lower Costs: Competition among fund houses and platforms will drive down fees, benefiting investors.

-

Sustainable Investing: ESG funds will grow as environmental and social concerns influence investment decisions.

Suggestions and Recommendations

To succeed in mutual fund investing:

-

Start early to maximize compounding benefits.

-

Diversify across asset classes and sectors to manage risk.

-

Prioritize low-cost funds to preserve returns.

-

Use SIPs for disciplined, long-term investing.

-

Regularly review and rebalance your portfolio.

-

Consult a financial advisor for complex needs or large portfolios.

-

Stay educated on market trends and fund performance.

Frequently Asked Questions (FAQs)

-

What is a mutual fund?

A mutual fund pools money from investors to buy a diversified portfolio of securities, managed by professionals. -

How do mutual funds work?

Investors buy shares in the fund, and the fund manager invests in assets to generate returns, which are distributed proportionally. -

Are mutual funds safe?

No investment is risk-free. Mutual funds carry market risk, but diversification reduces it compared to individual stocks. -

What is an SIP?

A Systematic Investment Plan (SIP) involves investing a fixed amount regularly, reducing market timing risks. -

How much should I invest in mutual funds?

Start with an amount you can afford, even $50 monthly. Align investments with your financial goals and income. -

What are the fees associated with mutual funds?

Fees include expense ratios, load fees, and transaction costs. Choose low-cost funds to maximize returns. -

Can I lose money in mutual funds?

Yes, mutual funds are subject to market risks, and losses are possible, especially in equity funds. -

What is the difference between active and passive mutual funds?

Active funds aim to outperform markets through manager decisions, while passive funds track indices for lower costs. -

How do I choose a mutual fund?

Consider your goals, risk tolerance, fund performance, fees, and the fund manager’s track record. -

Are mutual funds taxable?

Yes, capital gains and dividends are taxable, but tax-advantaged accounts like IRAs can reduce tax liability. -

What is an expense ratio?

The expense ratio is the annual fee for managing the fund, expressed as a percentage of assets. -

Can I invest in mutual funds for short-term goals?

Yes, debt or liquid funds are suitable for short-term goals due to their stability. -

What are index funds?

Index funds track market indices like the S&P 500, offering low costs and predictable performance. -

How often should I review my mutual fund portfolio?

Review annually or after significant life changes to ensure alignment with goals. -

What is a target-date fund?

A target-date fund adjusts its asset allocation over time, becoming more conservative as the target retirement date approaches.