In the demanding world of higher education, managing finances effectively stands as a cornerstone of success. Student budget planning emerges not merely as a financial exercise but as a vital skill that empowers individuals to navigate the complexities of academic life without undue stress. We delve deeply into the intricacies of crafting a student budget that aligns with personal needs, aspirations, and realities. By exploring comprehensive strategies, we equip learners with the tools to maintain fiscal discipline amidst tuition fees, living expenses, and recreational pursuits. This guide transcends basic advice, offering layered insights into income assessment, expense tracking, goal setting, and long-term adherence, ensuring that every aspect of financial management receives thorough attention.

- The Essential Role of a Student Budget in Academic Success

- Assessing Your Income Sources for an Effective Student Budget

- Tracking and Categorizing Expenses in Your Student Budget

- Setting Realistic Financial Goals Within Your Student Budget

- Choosing the Right Tools and Apps for Managing Your Student Budget

- Step-by-Step Guide to Creating Your First Student Budget

- Proven Strategies to Stick to Your Student Budget Long-Term

- Common Mistakes to Avoid When Building a Student Budget

- Adjusting Your Student Budget as Life Changes

- Incorporating Savings and Emergency Funds into Your Student Budget

- Managing Debt While Maintaining a Student Budget

- Exploring Part-Time Jobs to Boost Your Student Budget

- Leveraging Scholarships and Grants for Your Student Budget

- Frugal Living Tips to Enhance Your Student Budget

- Meal Planning and Grocery Strategies for a Tight Student Budget

- Transportation Options to Fit Your Student Budget

- Housing Choices That Align with Your Student Budget

- Entertainment and Socializing on a Student Budget

- Health and Wellness Expenses in Your Student Budget

- Technology and Study Tools for an Efficient Student Budget

- Travel and Breaks Within Your Student Budget

- Building Credit Responsibly as Part of Your Student Budget

- Preparing for Post-Graduation with Your Student Budget Habits

- Suggestions and Recommendations

- 15 FAQs with Answers

- 1. What is a student budget?

- 2. Why do students need a budget?

- 3. How do I start creating a student budget?

- 4. What tools can help with a student budget?

- 5. How often should I review my student budget?

- 6. What if my student budget shows a deficit?

- 7. Can part-time jobs fit into a student budget?

- 8. How do scholarships affect a student budget?

- 9. What are common mistakes in student budgeting?

- 10. How to save money on groceries in a student budget?

- 11. Is debt management part of a student budget?

- 12. How to handle emergency expenses in a student budget?

- 13. Can I travel on a student budget?

- 14. How does frugal living help a student budget?

- 15. What post-graduation benefits come from a student budget?

The Essential Role of a Student Budget in Academic Success

A well-structured student budget serves as the foundation for academic and personal growth. We recognize that students often face fluctuating incomes from part-time jobs, parental support, scholarships, or loans, making budgeting indispensable. Without a clear financial plan, unexpected costs like textbooks, transportation, or social events can derail progress. Consider the broader implications: financial strain contributes to mental health challenges, with studies indicating that over 60% of college students experience anxiety related to money matters. By establishing a student budget, we mitigate these risks, fostering an environment where focus remains on studies rather than survival.

Delving deeper, the psychological benefits of budgeting cannot be overstated. When we actively manage finances, a sense of control emerges, reducing the likelihood of impulsive spending. For instance, tracking daily expenditures reveals patterns—such as excessive coffee purchases—that cumulatively erode savings. We advocate for viewing budgeting as a proactive measure, akin to academic planning, where foresight prevents crises. Moreover, in an era of rising tuition costs averaging $10,000 to $50,000 annually depending on the institution, a student budget acts as a shield against debt accumulation. We emphasize that early adoption of these habits translates to lifelong financial literacy, positioning graduates favorably in the job market.

Expanding on this, societal shifts amplify the need for robust budgeting. With inflation impacting groceries, housing, and utilities, students must adapt dynamically. We explore how global events, like economic downturns, exacerbate these pressures, urging the integration of contingency funds within budgets. Through detailed case studies, such as a freshman balancing dorm fees and meal plans, we illustrate how neglecting budgeting leads to credit card reliance, perpetuating cycles of interest payments. Conversely, those who prioritize a student budget often report improved grades and extracurricular involvement, as financial security frees mental bandwidth.

Assessing Your Income Sources for an Effective Student Budget

Before constructing a student budget, we must meticulously evaluate all income streams. This step involves listing every potential source, from consistent allowances to sporadic gig economy earnings. Parental contributions, for example, might total $500 monthly, while scholarships could provide lump sums of $2,000 per semester. We recommend documenting these in a spreadsheet, noting frequencies—weekly, monthly, or quarterly—to forecast cash flow accurately. Irregular incomes, such as freelance writing gigs yielding $100 to $300 per project, require averaging over several months to avoid overestimation.

Further, we advise considering non-traditional sources like plasma donations, which can net $200 to $400 monthly in certain regions, or campus work-study programs offering $8 to $15 per hour. Tax refunds, often overlooked, can bolster funds if students file independently. By aggregating these, we create a realistic baseline. For international students, currency fluctuations add complexity; converting earnings from home countries demands regular updates to reflect exchange rates. We stress the importance of netting out taxes and fees, as gross figures mislead— a $1,000 scholarship might reduce to $850 after deductions.

In-depth analysis reveals hidden opportunities. Alumni networks sometimes offer micro-grants for specific needs, like research materials, ranging from $100 to $500. We encourage exploring government aid, such as Pell Grants in the U.S., which provide up to $6,895 annually without repayment. Part-time remote jobs, facilitated by platforms like Upwork, allow flexibility around class schedules. By quantifying these, we ensure the student budget rests on solid ground, preventing shortfalls that lead to borrowing. Long-term, this assessment cultivates resourcefulness, teaching students to diversify income for stability.

Tracking and Categorizing Expenses in Your Student Budget

Once income is assessed, we turn to expense tracking, a pivotal element of any student budget. This process demands vigilance, recording every outflow, no matter how minor. Apps like Mint or YNAB (You Need A Budget) automate much of this, categorizing spends into essentials like rent ($400-$800 monthly) and non-essentials like entertainment ($50-$150). We suggest starting with a 30-day audit: log purchases via receipts or bank statements to uncover averages, such as $200 on groceries or $100 on transportation.

Categorization refines this further. Fixed expenses—tuition, rent, utilities—remain constant, while variable ones—dining out, clothing—fluctuate. We break these down: housing might include utilities ($50-$100) and internet ($30-$60), while food encompasses groceries ($150-$300) and meals on campus ($100-$200). Health-related costs, like gym memberships ($20-$50) or medications, often surprise newcomers. By sub-dividing, we identify leaks; for example, subscription services ($10-$20 each) accumulate to $100 monthly if unchecked.

We advocate for granular tracking methods. Journaling expenses daily builds awareness, revealing how $5 daily lattes total $150 monthly. Digital tools offer visualizations—pie charts showing 40% on housing, 20% on food—facilitating adjustments. For shared living, we recommend splitting costs equitably, using apps like Splitwise to track roommate contributions. Seasonal variations, such as higher heating bills in winter ($50 extra), necessitate buffer allocations. Through this meticulous approach, the student budget becomes a dynamic tool, adaptable to life’s ebbs and flows.

Extending this, we explore psychological triggers behind spending. Impulse buys, driven by stress or peer pressure, undermine budgets. We propose mindfulness techniques, like pausing 24 hours before non-essential purchases, to curb these. Longitudinally, tracking over semesters highlights trends, such as increased spending during finals due to comfort foods. By addressing these, we fortify the student budget against erosion, ensuring sustainability.

Setting Realistic Financial Goals Within Your Student Budget

Goal setting infuses purpose into a student budget. We begin with short-term objectives, like saving $200 for textbooks, progressing to long-term aims such as $1,000 emergency funds. SMART criteria—Specific, Measurable, Achievable, Relevant, Time-bound—guide this: “Save $50 monthly for a laptop by year’s end.” Aligning goals with values, such as prioritizing travel over gadgets, personalizes the process.

We detail hierarchies: immediate needs (debt repayment) versus wants (vacations). For debt-laden students, goals might target paying off $5,000 in loans within two years via minimum payments plus extras. Savings goals, like 10% of income allocated to high-yield accounts (0.5%-2% interest), build wealth. Investment introductions, such as low-risk index funds, suit advanced planners, though we caution against risks with limited funds.

Incorporating milestones enhances motivation. Celebrating $100 saved with a low-cost reward reinforces habits. We address common pitfalls, like overly ambitious goals leading to discouragement—starting small, like $20 weekly savings, proves effective. For graduate students, goals might include conference funding ($500-$1,000), integrated into the student budget via dedicated categories. This structured approach transforms abstract desires into tangible achievements.

Choosing the Right Tools and Apps for Managing Your Student Budget

Technology streamlines student budget management. We evaluate popular apps: Mint for free tracking, linking bank accounts for real-time updates; YNAB for envelope budgeting, assigning every dollar a job. Excel spreadsheets offer customization, with formulas calculating surpluses (income minus expenses). For visual learners, PocketGuard’s graphs depict spending patterns.

We compare features: security (two-factor authentication), integration (with banks, credit cards), and cost (free versus $11.99/month for premium). Mobile accessibility ensures on-the-go logging, crucial for busy schedules. Advanced tools like Acorns round up purchases for investments, turning $1.50 coffees into savings. For international students, apps handling multi-currency, like XE, prevent conversion errors.

Custom setups, such as Google Sheets templates with conditional formatting (red for overspending), empower users. We discuss privacy concerns, advising review of data policies. Automation—recurring transfers to savings—reduces manual effort. By selecting tools aligning with needs, we enhance student budget efficacy, making adherence effortless.

Step-by-Step Guide to Creating Your First Student Budget

Crafting a student budget follows a systematic process. Step one: tally monthly income, averaging variables. Step two: list expenses, estimating averages from tracking. Step three: subtract expenses from income, aiming for positive balances. If negative, prioritize cuts—reduce dining out from $150 to $75.

Step four: allocate categories—50% needs (rent, food), 30% wants (entertainment), 20% savings/debt. Adjust for realities; commuters might allocate more to transport ($100-$200). Step five: incorporate buffers, 10% for emergencies. Step six: review weekly, tweaking as needed.

We provide templates: income section (sources, amounts), expense table (categories, budgeted vs. actual). For visual aids, pie charts allocate percentages. This blueprint ensures the student budget is comprehensive, covering nuances like seasonal costs (holiday gifts, $100-$300).

Proven Strategies to Stick to Your Student Budget Long-Term

Adherence demands discipline. We suggest accountability partners—roommates reviewing spends monthly. Habit formation, like weekly check-ins, solidifies routines. Rewards systems—treats for under-budget months—motivate.

Common temptations, like sales, require scrutiny: “Do I need this?” We promote frugality: cooking in bulk saves $100 monthly on food. Mindset shifts, viewing budgets as empowering, combat resistance. For lapses, analyze causes without self-judgment, adjusting promptly.

Long-term, annual reviews accommodate changes, like income increases from promotions. Community resources, like financial workshops, provide support. By implementing these, we sustain the student budget, turning it into a lifelong practice.

Common Mistakes to Avoid When Building a Student Budget

Pitfalls abound in student budget creation. Underestimating expenses—forgetting laundry ($20 monthly)—leads to shortfalls. Over-optimism about income ignores inconsistencies. Neglecting inflation adjusts costs upward 2-3% yearly.

Rigid budgets fail flexibility; we advocate adaptability. Ignoring small spends accumulates; $2 daily snacks total $60 monthly. Emotional spending, post-exam binges, derails plans. We recommend audits to catch these.

Debt mismanagement—minimum payments only—accrues interest. Prioritize high-interest debts. Forgetting goals dilutes purpose; regular reminders help. By sidestepping these, the student budget remains robust.

Adjusting Your Student Budget as Life Changes

Life’s flux necessitates student budget revisions. Semester starts might increase book costs ($300-$500); we suggest reallocating from entertainment. Income boosts, like raises, allow savings increases.

Major shifts—moving off-campus—alter housing ($500 to $800). Health issues add medical expenses ($100-$500). We propose quarterly reviews, comparing actuals to budgets. Tools like alerts for overspending aid timely tweaks.

For graduates transitioning, budgets evolve to include job searches ($100 travel). This adaptability ensures the student budget endures beyond academia.

Incorporating Savings and Emergency Funds into Your Student Budget

Savings integrate seamlessly into student budgets. We recommend automating 10-20% transfers post-payday. Emergency funds, 3-6 months’ expenses ($1,500-$3,000), cushion shocks.

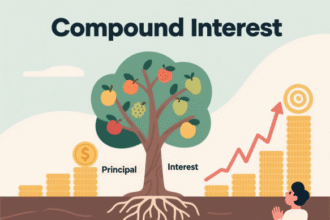

Strategies: high-yield accounts (1-4% APY), micro-savings apps. Cutting luxuries funds this—skip $30 movies for home alternatives. Compound interest grows modest sums; $50 monthly at 5% yields $3,300 in five years.

For low-income students, start small ($10 weekly). We emphasize prioritization: savings before wants. This builds security, integral to a resilient student budget.

Managing Debt While Maintaining a Student Budget

Debt looms large for students. We outline types: federal loans (3-6% interest), private (5-12%). Budgets allocate minimum payments, plus extras to reduce principal.

Consolidation lowers rates; refinancing suits good credit. Side hustles—tutoring ($20/hour)—accelerate payoffs. We warn against new debt; use cash for purchases.

Tracking progress motivates; debt snowball pays smallest first. Resources like counselors offer plans. Balancing debt with student budget prevents escalation.

Exploring Part-Time Jobs to Boost Your Student Budget

Part-time work supplements student budgets. Campus roles—library assistants ($10-15/hour)—fit schedules. Remote gigs, like virtual assisting ($15-25/hour), provide flexibility.

We advise 10-20 hours weekly to avoid burnout. Platforms: Indeed, Handshake. Negotiating hours ensures balance. Earnings directly fund categories, enhancing the student budget.

Taxes: withholdings reduce take-home; plan accordingly. Benefits like experience build resumes. Strategic job choices align with majors, enriching the student budget.

Leveraging Scholarships and Grants for Your Student Budget

Scholarships ease student budget strains. Merit-based awards ($1,000-$10,000) reward academics; need-based consider finances.

Applications: essays, recommendations. Deadlines vary; track via apps. Renewables require GPA maintenance.

Grants like TEACH ($4,000) target fields. International options exist. Integrating awards reduces loans, fortifying the student budget.

Frugal Living Tips to Enhance Your Student Budget

Frugality maximizes student budgets. Bulk buying groceries saves 20-30%. Thrift shopping clothes ($5-20 items) cuts costs.

Public transport passes ($50 monthly) versus driving. Free events—campus lectures—replace paid entertainment. Cooking shared meals divides expenses.

Energy conservation lowers utilities. Selling unused items generates cash. These habits extend the student budget significantly.

Meal Planning and Grocery Strategies for a Tight Student Budget

Meal planning optimizes food in student budgets. Weekly menus based on sales; apps like Mealime suggest recipes.

Budget: $200-300 monthly. Staples: rice, beans ($1-2/pound). Batch cooking freezes portions, reducing waste.

Discount stores, coupons save 15-20%. Vegetarian options cheaper. This ensures nutrition within the student budget.

Transportation Options to Fit Your Student Budget

Transportation impacts student budgets. Biking eliminates costs; public transit ($1-3/ride) affordable.

Carpooling shares gas ($50 monthly). Campus shuttles free. Walking promotes health.

For longer trips, budget flights via Skyscanner. Efficient choices preserve the student budget.

Housing Choices That Align with Your Student Budget

Housing consumes 30-50% of student budgets. Dorms ($400-800/month) include utilities; off-campus ($300-600) shared.

Leases: read fine print. Roommates divide rent. Subletting summers saves.

Location matters—proximity reduces transport. Wise selections sustain the student budget.

Entertainment and Socializing on a Student Budget

Social life fits student budgets. Free parks, potlucks over restaurants. Student discounts (10-50%) for movies, events.

Clubs offer activities. Home game nights low-cost. Balancing fun with finances maintains the student budget.

Health and Wellness Expenses in Your Student Budget

Health allocation in student budgets: insurance ($100-300/month), gym ($20-50).

Preventive care avoids costs. Campus clinics free. Mental health resources essential.

Fitness: free apps, runs. Prioritizing health safeguards the student budget.

Technology and Study Tools for an Efficient Student Budget

Tech in student budgets: laptops ($300-800), software free via schools.

Refurbished options save. Cloud storage gratis. Apps enhance productivity without extra spend.

Managing these keeps the student budget intact.

Travel and Breaks Within Your Student Budget

Breaks on student budgets: hostels ($20-50/night), buses over flights.

Planning ahead secures deals. Staycations explore locally. These enrich without straining the student budget.

Building Credit Responsibly as Part of Your Student Budget

Credit building in student budgets: secured cards ($200 deposit).

Timely payments boost scores. Monitoring reports free. Good credit aids future loans, aligning with the student budget.

Preparing for Post-Graduation with Your Student Budget Habits

Habits from student budgets transition post-grad. Resume building includes financial skills.

Job searches budget $100-200. Relocation plans. Lifelong budgeting starts here.

Suggestions and Recommendations

We suggest starting with a simple spreadsheet for your student budget and gradually incorporating apps for automation. Recommend reviewing your budget bi-weekly to catch discrepancies early. For savings, opt for high-yield online banks. Avoid credit card debt by paying balances monthly. Engage in financial literacy courses offered by universities. Track progress with monthly net worth calculations. Diversify income through skills like coding or graphic design. Use cash envelopes for discretionary spending to limit overspending. Partner with a study buddy for mutual accountability. Explore community resources like food banks if needed. Prioritize mental health to prevent stress-induced spending. Set annual financial challenges, like no-spend months. Invest in durable goods to reduce replacement costs. Negotiate bills where possible, such as internet plans. Build a network for job opportunities.

15 FAQs with Answers

1. What is a student budget?

A student budget is a financial plan outlining income and expenses to manage money effectively during academic years.

2. Why do students need a budget?

Students need a student budget to avoid debt, reduce stress, and focus on studies by controlling spending.

3. How do I start creating a student budget?

Begin by assessing income, tracking expenses for a month, then allocating funds to categories in a student budget.

4. What tools can help with a student budget?

Apps like Mint, YNAB, and Excel are excellent for managing a student budget.

5. How often should I review my student budget?

Review your student budget weekly or monthly to adjust for changes.

6. What if my student budget shows a deficit?

Cut non-essential expenses or increase income to balance your student budget.

7. Can part-time jobs fit into a student budget?

Yes, part-time jobs boost income and can be scheduled around classes in a student budget.

8. How do scholarships affect a student budget?

Scholarships provide non-repayable funds, reducing reliance on loans in your student budget.

9. What are common mistakes in student budgeting?

Underestimating expenses and ignoring small spends are frequent errors in a student budget.

10. How to save money on groceries in a student budget?

Plan meals, buy in bulk, and use coupons to save in your student budget.

11. Is debt management part of a student budget?

Yes, allocating for repayments is crucial in a student budget.

12. How to handle emergency expenses in a student budget?

Build an emergency fund of 3-6 months’ expenses within your student budget.

13. Can I travel on a student budget?

Yes, with budget options like hostels and public transport in your student budget.

14. How does frugal living help a student budget?

Frugal habits like thrift shopping extend funds in a student budget.

15. What post-graduation benefits come from a student budget?

Habits from a student budget lead to better financial management in adulthood.